Despite a down year for clean energy investment, 2016 photovoltaic capacity deployment scaled new heights in less developed countries: www.global-climatescope.org

London, Washington D.C. and Shanghai, November 28, 2017 – New solar-powered generating capacityis growing at a crackling pace in emerging markets. The growth is fuelled by low-priced equipment and innovative new applications that are expanding energy access for millions, Bloomberg New Energy Finance (BNEF) finds in a comprehensive new study of clean energy activity in key developing nations.

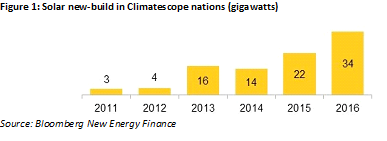

A total of 34 gigawatts of new solar-power generating capacity came on line in 2016 in 71 emerging market countries studied by BNEF as part of its annual Climatescope survey (www.global-climatescope.org), which was released at the BNEF Future of Energy Summit in Shanghai. That’s up from 22 gigawatts in 2015 and 3 gigawatts as recently as 2011.Totalcumulative solar capacity grew 54% year-on-year and has more than tripled in three years. Capacity added in 2016 alone would meet the total annual electricity demands of 45 million homes in India, or of every home in Peru or Nigeria.

China accounted for the vast majority of this with 27gigawatts added, by far the most of any country. But other nations saw strong growth as well. India added 4.2gigawatts. Meanwhile, Brazil, Chile, Jordan, Mexico, and Pakistan and nine other nations all saw installed photovoltaic capacity double or more in 2016. Overall, solar accounted for 19% of all new generating capacity added in Climatescope countries last year, up from 10.6% in 2015 and 2% in 2011.

The use of photovoltaics in micro-grids, pay-as-you-go battery/lantern systems, water pumps, and even mobile phone towers is proliferating. Often, these efforts have flourished organically, unencumbered by governments andoften led by entrepreneurs and venture capitalists. Most often, start-upshave taken the lead, securing financing from private sources and forging partnerships with large corporations such as telecom providers.

More than 1.5 million households in Africa now use solar home systems that were bought on a mobile-money enabled financing plan, up from just 600,000 at the end of 2015. In Africa’s solar financing market, this business model is no longer niche and has closed some of the largest deals this year. The combination of solar power, end-customer financing and smart technology is spreading beyond homes into farms and connectivity hubs. For instance, the number of solar irrigation pumps installed in India has reached 128,000 in May, up from just 12,000 in April 2014.

“The massive drop in photovoltaic module prices we’ve seen over the last several years continues to reverberate through developing countries,” said Ethan Zindler, Head of Americas for BNEF. “It’s creating opportunities ranging from multi-million dollar projects that serve the grid, to small-scale installations that enable farmers to boost their yields through better irrigation and connect to the Internet.”

Figure 1: Solar new-build in Climatescope nations (gigawatts)

Climatescopeis a detailed, country-by-country quantitative assessment of clean energy market conditions and opportunities of nations in South America, Europe, Africa, the Middle East, and Asia. The 71 countries account for 32.5% of global GDP and 72.4% of global population, as well as the vast majority of economic activity across all non-OECD nations. (Total solar build across all non-OECD countries in 2016 was 34.6 gigawatts).

Based on 43 data indicators and 179 sub-indicators, Bloomberg New Energy Finance determines scores for each nationon a 0-5 basis andthen ranks them. Despite the solar surge, this year’s survey included some troubling findings:

- For the first time since Climatescope was launched four years ago, the average country score fell year-on-year. Nations sampled collectively scored 1.35 in last year’s survey (out of 5). That average fell to 1.19 this year, though the figure was skewed somewhat with the addition to the survey of 13 new nations from Central Asia and Europe many of which scored low;

- The lower scores were attributable to lower clean energy investment and lackluster progress on policy-making. Total new clean energy investment in non-OECD countries fell by $40.2 billion to $111.4 billionin 2016 from $151.6 billion in 2015. While China accounted for three quarters of the decline, new clean energy investment in all other non-OECD countries also fell 25% from 2015 levels;

- In terms of policy, of the nations researched by BNEF, 76% have established domestic CO2 containment goals. However, only two thirds (67%) have introduced feed-in tariffs or auctions to support clean energy projects, and just 18% have set domestic greenhouse gas emissions reduction policies. These detailed, technical regulations have proven critical to attracting private capital in developing countries clean energy and facilitating scale-up;

- China topped the survey once again. The country remains the world’s single largest market for clean energy development, but saw new asset (project) investment fall by $36.6 billion year-on-year. Seven of the top 10 ranked nations scored lower this year than in the prior survey. Brazil, Jordan, Mexico, India, South Africa, Chile, Kenya, Uruguay and Vietnam comprise the rest of the top 10.