Tariq Saeedi

The technological revolution spearheaded by the combined force of blockchain technology, P2P networking, and 5G technology is creating the digital economy.

It should be clear that the digital currencies or cryptocurrencies are not an isolated phenomenon. They are part of the digital revolution that is shaping the digital economy.

We can see it coming, we can feel it affecting our lives, and yet it is a bit early to define it in authoritative terms.

A report issued by UNCTAD in September 2019 avoids defining the digital economy simply because at this stage it is not possible to come up with a clear-cut definition. As the UNCTAD report points correctly, assigning any definition may amount to straitjacketing the concept.

The complete, 194-page report can be found here:

Digital Economy Report 2019

Value Creation and Capture: Implications for Developing Countries

UNCTAD, 4 September 2019

https://unctad.org/en/PublicationsLibrary/der2019_en.pdf

Even though the UNCTAD report declines to define the digital economy, it identifies the components of a digital economy.

Here is a long but useful passage from the report:

[Some of the information in this quoted portion of the UNCTAD report has been given in the earlier parts of this series]

- Main components of the digital economy

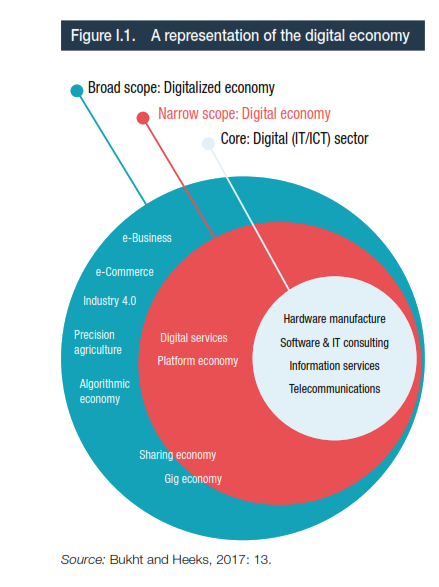

With digital technologies underpinning ever more transactions, the digital economy is becoming increasingly inseparable from the functioning of the economy as a whole. The different technologies and economic aspects of the digital economy can be broken down into three broad components:

- Core aspects or foundational aspects of the digital economy, which comprise fundamental innovations (semiconductors, processors), core technologies (computers, telecommunication devices) and enabling infrastructures (Internet and telecoms networks).

- Digital and information technology (IT) sectors, which produce key products or services that rely on core digital technologies, including digital platforms, mobile applications and payment services. The digital economy is to a high degree affected by innovative services in these sectors, which are making a growing contribution to economies, as well as enabling potential spillover effects to other sectors.

iii. A wider set of digitalizing sectors, which includes those where digital products and services are being increasingly used (e.g. for e-commerce). Even if change is incremental, many sectors of the economy are being digitalized in this way. This includes digitally enabled sectors in which new activities or business models have emerged and are being transformed as a result of digital technologies.

Examples include finance, media, tourism and transportation. Moreover, although less often highlighted, digitally literate or skilled workers, consumers, buyers and users are crucial for the growth of the digitalized economy.

These components are being used in various ways as a basis for measuring the extent and impact of the digital economy. At their most basic level, methodologies focus on measures of the core and digital/IT sectors (or suitable proxies), notably related to investment and policies relating to the digital economy (e.g. digital infrastructure investments, broadband adoption), and how these are linked to the growth of that economy, particularly in terms of outputs and employment in the digital and digitally enabled sectors (OECD, 2017a; UNCTAD 2017a and b). Such analyses help to provide direction for policies and investments in the digital economy, and to assess potential impacts on firms, consumers and workers.

Measuring the digital economy beyond digital and digitally enabled sectors is more difficult. Impacts from the use of digital technologies may result from spillover effects, and intangible outcomes (such as firm flexibility, management approaches or productivity) also depend on other variables (Brynjolfsson, 1993).

Some studies have assessed digitalization by means of surveys and e-commerce data, by measuring the spillover effects from the ICT/digital sectors across an economy (Barefoot et al., 2018; Knickrehm et al., 2016), or by exploring the changing geography of global data and knowledge (Manyika et al., 2014; Ojanperä et al., 2016). These approaches often face limitations due to methodological challenges and the lack of reliable statistics.

Proposed definitions of the digital economy tend to be closely linked to the components outlined above.

One approach, which is broadly aligned with a number of other studies (e.g. Barefoot et al., 2018; OECD, 2012a; UNCTAD, 2017a), is the definition of the digital economy proposed by Bukht and Heeks (2017:17): “That part of economic output derived solely or primarily from digital technologies with a business model based on digital goods or services”.

Another approach is to view the digital economy as encompassing all the ways in which digital technologies are diffusing into the economy (Brynjolfsson and Kahin, 2002). Knichrehm et al. (2016: 2) define the foundations of the digital economy in broader terms, suggesting that it is: “The share of total economic output derived from a number of broad “digital” inputs. These digital inputs include digital skills, digital equipment (hardware, software and communications equipment) and the intermediate digital goods and services used in production. Such broad measures reflect the foundations of the digital economy”.

Given the focus on value creation and capture in this Report, emphasis is given to the processes and changes in the digital (or overall) economy, rather than to the outcomes of activities. This has implications for the types of policies needed in relation to how the digital economy operates (and less on the requisite conditions for the emergence of such an economy).

While it is necessary to pay attention to specific technologies, a focus on broader trends, such as platformization, digital data and e-commerce, is also needed. This enables an analysis of changes in the digital economy while acknowledging that such changes might happen in different ways. The above definitions highlight the varying emphases: either towards cutting-edge activities in the digital sector or the broader digitalization of the economy. Thus, the representation of the digital economy in this Report follows that used in UNCTAD (2017a), which is reproduced in figure I.1.

It should be noted that in discussions about the dynamic digital economy, reference is frequently made to “digital infrastructure”, a concept that still lacks a widely accepted definition. It may be useful to consider different levels of digital infrastructure:

(i) ICT networks (the core digital infrastructure for connectivity);

(ii) data infrastructure (data centres, submarine cables and cloud infrastructure);

(iii) digital platforms; and

(iv) digital devices and applications.

Some experts also include the data themselves as part of the digital infrastructure.

In the case of digital platforms, while they are not strictly infrastructure (they can also be agents participating in the activity that takes place on them), they also perform infrastructure-like functions by connecting two or more sides of a market. Moreover, at a zero level, electricity infrastructure is essential to enable the use of digital infrastructure, as these technologies need power to run. In this Report, this broad and flexible approach is applied to the use of the term, digital infrastructure, depending on the context.

TRENDS IN EMERGING DIGITAL TECHNOLOGIES

The evolution of the digital economy is closely associated with progress in several frontier technologies, including some key software-oriented technologies, such as blockchain, data analytics and AI. Other emerging technologies range from user-facing devices (such as computers and smartphones) to 3D printers and wearables, as well as specialized machine-oriented hardware, such as IoT, automation, robotics and cloud computing.

Rapid advances in these increasingly converging technologies have been enabled by a surge in capacity – as well as considerable cost reductions – of data storage, processing and transmission.

Detailed descriptions and analyses of each of these technologies have been extensively presented elsewhere.

This section focuses on some recent trends and prospects for these technologies and their geographical evolution, in order to provide an indication of the relative position of developing countries in the evolving digital technology landscape.

- Blockchain technologies

Blockchain technologies are a form of distributed ledger technologies that allow multiple parties to engage in secure, trusted transactions without any intermediary. It is best known as the technology behind cryptocurrencies, but it is also of relevance for many other domains of importance to developing countries.

These include digital identification, property rights and aid disbursement. Open-source platforms, such as Ethereum, allow programmers to develop decentralized applications to run on their blockchain.

However, one challenge for blockchains is that, for some applications, they require a substantial, reliable electricity supply for processing.

Some blockchain applications are already in use in developing countries, for example in the areas of fintech, land management, transport, health and education in Africa (UNECA, 2017).

According to Gartner’s blockchain business value forecast, after the first phase of a few high-profile successes in 2018–2021, there will be larger, focused investments and many more successful models in 2022–2026. And these are expected to explode in 2027–2030, reaching more than $3 trillion globally (WTO, 2018). Currently, China alone accounts for nearly 50 per cent of all patent applications for technology families relating to blockchains, and, together with the United States, they represent more than 75 per cent of all such patent applications (ACS, 2018).

- Three-dimensional printing

Three-dimensional (3D) printing, also known as additive manufacturing, can potentially disrupt manufacturing processes by boosting international trade in designs rather than in finished products.

It offers opportunities for developing countries to leapfrog traditional manufacturing processes. Indeed, a number of 3D-printing ventures can already be found in some developing countries. For example, in Africa, such ventures exist for local entrepreneurship in Togo, for medical supplies in Uganda, for filling import gaps in Nigeria, for commercial ventures in South Africa and for renewable energy in Rwanda (Atlantic Council, 2018). India’s largest bicycle and scooter maker has been using 3D printing since 2014, allowing products to reach markets at faster rates; and 3D printers are being used to create prosthetics in countries such as Cambodia, the Sudan, Uganda and the United Republic of Tanzania.

But 3D-printing capacity remains highly concentrated. In fact, the five leading countries (the United States, followed by China, Japan, Germany and the United Kingdom) account for an estimated 70 per cent of the total.

- Internet of things

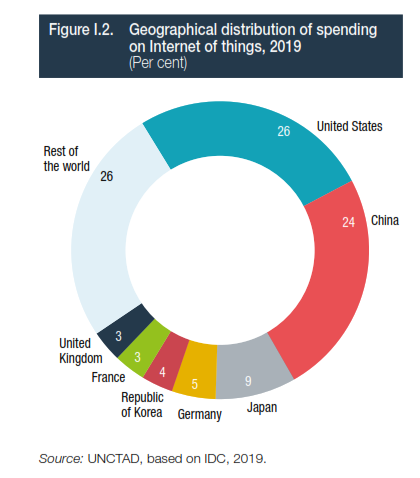

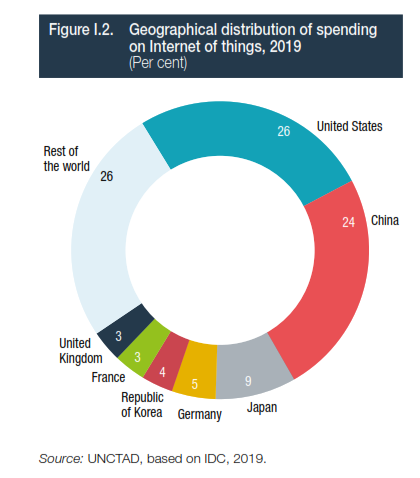

Internet of things (IoT) refers to the growing array of Internet-connected devices such as sensors, meters, radio frequency identification (RFID) chips and other gadgets that are embedded in various everyday objects enabling them to send and receive various kinds of data. It has wide applications, including in energy meters, for RFID tagging of goods for manufacturing, livestock and logistics, for monitoring soil and weather conditions in agriculture, and for wearables. In 2018, there were more “things” (8.6 billion) connected to the Internet than people (5.7 billion mobile broadband subscriptions), and the number of IoT connections are forecast to grow at 17 per cent a year, to exceed 22 billion by 2024 (Ericsson, 2018). The top seven countries (the United States, followed by China, Japan, Germany, Republic of Korea, France and the United Kingdom) account for nearly 75 per cent of worldwide spending on IoT, with the first two countries representing 50 per cent of global spending (figure I.2).

The global IoT market is expected to grow tenfold, from $151 billion in 2018 to $1,567 billion by 2025 (IoT Analytics, 2018). IDC (2018) estimates that by 2025, an average connected person in the world will interact with IoT devices nearly 4,900 times per day, or the equivalent of one interaction every 18 seconds.

This represents an exponential increase in comparison to 298 times per day in 2010 and 584 in 2015. Such rapid growth in the use of IoT will generate a further expansion of digital data.

- 5G mobile broadband

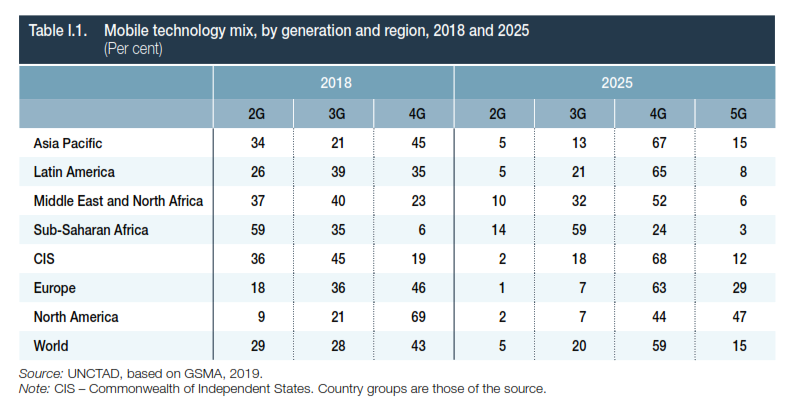

Fifth generation (5G) wireless technology is expected to be critical for IoT due to its greater ability to handle massive volumes of data. 5G networks can process around 1,000 times more data than today’s systems (Afolabi et al., 2018). In particular, it offers the possibility to connect many more devices (e.g. sensors and smart devices). While 72 mobile operators were testing 5G in 2018, 25 of them are expected to launch the service in 2019, and another 26 in 2020 (Deloitte, 2019). It is estimated that by 2025, the United States, followed by Europe and Asia Pacific will be leaders in 5G adoption. In order for developing countries to maximize the impact of IoT, significant investments in 5G infrastructure will be required. By 2025, the share of 5G in total connections is expected to reach 59 per cent in the Republic of Korea, compared with only 8 per cent in Latin America and 3 per cent in subSaharan Africa (table I.1). Moreover, the deployment of 5G may further increase the urban-rural digital divide, as setting up 5G networks in rural areas with lower demand will be commercially challenging (ITU, 2018a).

- Cloud computing

Cloud computing is enabled by higher Internet speeds, which have drastically reduced latency between users and far away data centres. Data storage costs have also plummeted. The cloud is transforming business models, as it reduces the need for in-house IT expertise, offers flexibility for scaling, and consistent applications rollout and maintenance (UNCTAD, 2013). Some free cloud services provide office-like application tools that are useful for micro, small and medium-sized enterprises (MSMEs). This is particularly useful for countries where the cost of licensed software can be an obstacle to creating applications and providing services. However, in many developing countries, high costs of additional international bandwidth to access overseas servers and data centres still limit the uptake of cloud services.

Most cloud traffic is generated in North America, followed by Asia Pacific and Western Europe, which together account for about 90 per cent of all cloud traffic (figure I.3). From 2016 to 2021, the fastest annual growth rate in cloud traffic is expected to occur in the Middle East and Africa, at 35 per cent, followed by Central and Eastern Europe and Asia Pacific, each with a growth rate of 29 per cent. The cloud market is also highly concentrated. According to Synergy Research Group (2019), the share of the top five providers − Amazon Web Services (AWS), Microsoft, Google, IBM and Alibaba − in the global cloud infrastructure services market exceeds 75 per cent, with AWS alone accounting for over a third of that market.

- Automation and robotics

Automation and robotics technology are increasingly used in manufacturing, which could have significant impacts on employment. There are concerns that such technologies may constrain the scope for developing countries to adopt export-led manufacturing as a path to industrialization (UNCTAD, 2017c), and that the more developed economies may increasingly use robots to “reshore” manufacturing jobs. According to the International Federation of Robotics (2018), global sales of industrial robots doubled between 2013 and 2017. This trend seems set to continue, with sales expected to increase from 381,300 units in 2017 to 630,000 units by 2021. The top five markets (China, followed by Japan, the Republic of Korea, the United States and Germany) represented 73 per cent of the total sales volume of robots in 2017. China is showing the strongest demand, with a market share of 36 percent. Robots are mainly used in the automotive, electrical/electronics and metal industries.

- Artificial intelligence and data analytics

Developments in AI, including machine learning, are enabled by the large amounts of digital data that can be analysed to generate insights and predict behaviour using algorithms, as well as by advanced computer processing power. AI is already in use in areas such as voice recognition and commercial products (such as IBM’s Watson). It has been estimated that this general-purpose technology has the potential to generate additional global economic output of around $13 trillion by 2030, contributing an additional 1.2 per cent to annual GDP growth (ITU, 2018b). At the same time, it may widen the technology gap between those that have and those that do not have the capabilities to take advantage of this technology. China and the United States are set to reap the largest economic gains from AI, while Africa and Latin America are likely to see the lowest gains.

China, the United States and Japan together account for 78 per cent of all AI patent filings in the world (WIPO, 2019).

Another related key technology in the digital economy is data analytics, sometimes dubbed as “big data”. This refers to the increasing capacity to analyse and process massive amounts of data. Indeed, the above technologies have one element in common, which is that they strongly rely on data. As will be seen in chapter II and throughout this Report, digital data are one of the core elements of value creation in the digital economy. Thus, the following section focuses on different variables related to data.

* * *

So far, we have seen that digital currencies or cryptocurrencies are not an alcove novelty. They are a part of the digital revolution that is shaping the digital economy.

In the concluding part of this series we would propose some steps that Central Asia may like to take as soon as possible. /// nCa, 22 November 2019

To be continued . . .