Kazım Gündoğar, General Manager, Turkmen Turkish Commercial Bank

Turkmen-Turkish Commercial Bank was established (licenced) 27 years ago on 31 March, 1993 in accordance with the Intergovernmental Memorandum signed between Turkmenistan and the Republic of Turkey on 02 May, 1992 as the first joint stock bank in Turkmenistan with foreign investment and started operations on 21 September 1993.

Shareholders of the Bank: from Turkmen side – «Agrosenagatbank» (at present State Commercial Bank “Dayhanbank”) and from side of Republic of Turkey – Ziraat Bank with an equal stake of 50/50 percent ownership.

Turkmen-Turkish Commercial Bank-Head Office/Ashgabat

We are using the benefits and advantages of our shareholder, 157 years-old Ziraat Bank which has Turkey’s largest international service network in numerous countries all over the world and on the other side, our Turkmen shareholder Dayhanbank, being the oldest and largest Turkmen Bank stands behind us with its strong state capital.

Over the years, in line with fast growing economy of Turkmenistan, Turkmen-Turkish Commercial Bank (TTCB) is also growing rapidly creating high value to the Banking sector of Turkmenistan.

The bank regards customer focus and customer satisfaction as being fundamental to everything. The goal is to offer banking products and services to all of our existing and potential customers in formats that are practical, intelligible and accessible.

In the recent years, TTCB has changed its corporate organization and applied new business models according to the requirements of modern banking practices in the world. As a result of competition brought in the industry, not only the banking sector would reach a rapid development pace but also the customers could benefit from it highly.

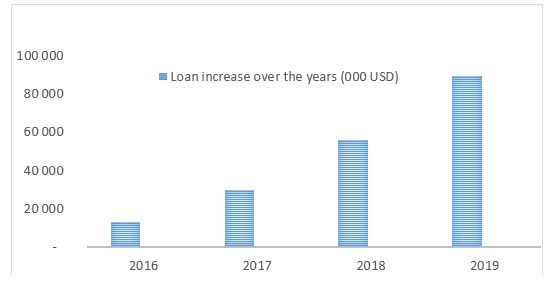

The bank has focused mainly on corporate loans in recent years one third of which is foreign currency loans. Parallel to the economic development goals of Turkmenistan, it is supporting real sector investments of private sector. As a result of loans mainly granted to the agricultural, food production and manufacturing sectors, the loan portfolio of the bank increased around 6 times in the last few years and as a result, thousands of new jobs have been created in Turkmenistan economy. Some of those investments which have been financed by TTCB are now exporting their products, by generating foreign currency, now capable of supporting the foreign trade balance of the country.

See loan increase chart below:

As it has always been since 1993, the bank will continue to provide strong financial support to the real sector in line with the long term economic development program of the government.

Additionally, TTCB has always been at the customers’ side with all distributing channels such as ATMs, Internet Branch, POS terminals etc. along with seven service locations (ofices) all over the country.

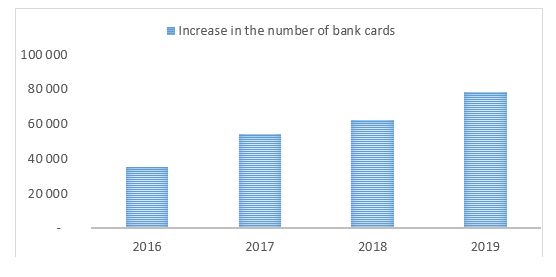

One of the main business focus of the bank is to provide services in the areas of international trade, local payments, trade finance, Western Union, bank cards with our broad range of products. Considerable increase in the number of bank cards supports the economic goal of the country in reducing and controlling unregistered economy.

The chart below shows the development of card business in TTCB.

We offer the most appropriate products with the most favorable and flexible terms in the sector. We will continue to support Turkmenistan economy by supporting its digitalization efforts with innovative products as we have done since 1993. /// nCa, 24 March 2020