Elvira Kadyrova

ADB has published the supplement to its annual flagman economic report titled “Asian Development Outlook 2020 Supplement: Lockdown, Loosening, and Asia’s Growth Prospects”.

The last Asian Development Outlook 2020 was released early April. So far, the number of COVID-19 cases worldwide has grown from less than 1 million to over 7 million. The developing Asia accounts for 10.7% of the total cases.

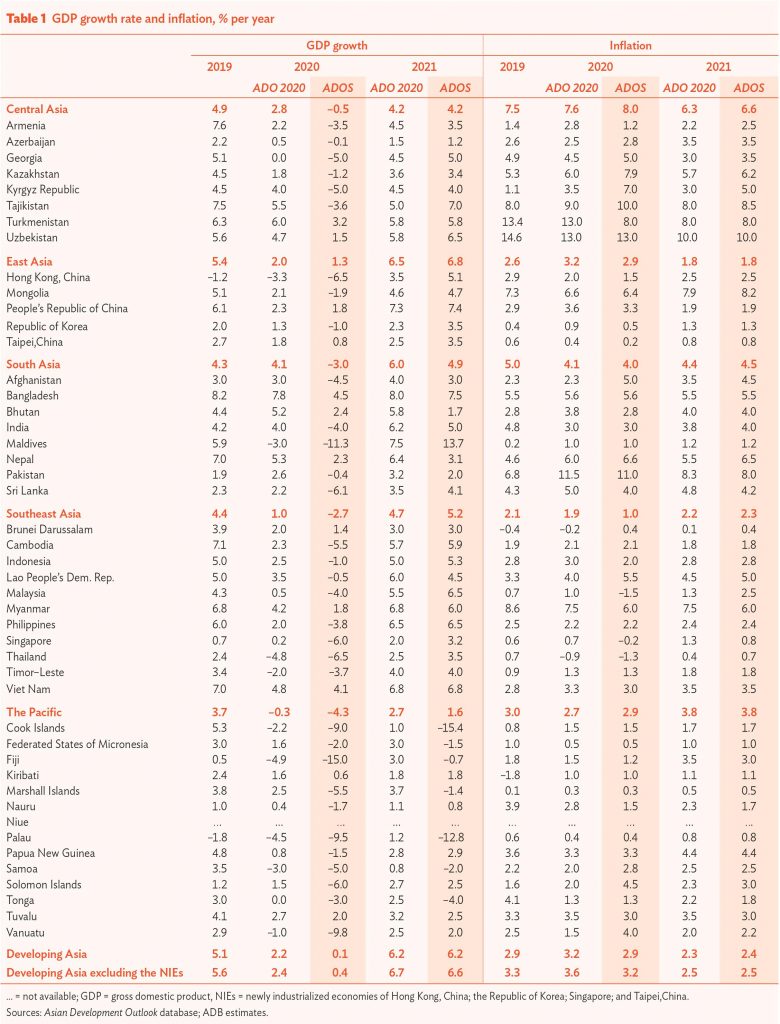

Central Asia’s economic activity is expected to contract by 0.5% compared to the 2.8% growth forecast in April due to trade disruptions and low oil prices. Growth is forecasted to recover to 4.2% in 2021, says ADB.

Here is the chapter from the report, devoted to Central Asia:

Central Asia

The COVID-19 pandemic prompts a downward adjustment to the 2020 projection for Central Asia from 2.8% growth to 0.5% contraction. The 4.2% growth projection for 2021 is unchanged. The 2020 forecast for Kazakhstan, the largest economy in the subregion, is revised down from 1.8% growth to 1.2% contraction, with the growth forecast for 2021 only marginally adjusted from 3.6% to 3.4%. The first 4 months of 2020 saw contraction by 0.2% year on year. The service sector was the most significantly affected, shrinking by 4%, while growth remained positive in the rest of the economy. Mining grew by 6%, primarily from oil and gas extraction, but such growth is unlikely in the rest of this year as Kazakhstan adheres to oil production cuts agreed by the Organization of the Petroleum Exporting Countries and others (OPEC+). A 1-month state of emergency declared on 15 March was subsequently extended several times to 11 May, and local quarantine measures and strict social distancing will likely continue to be applied selectively. The government’s fiscal stimulus package, equal to 9% of GDP, is expected to mitigate the economic downturn. As of early May, social protection payments were made to 4.5 million applicants who had lost incomes because of the emergency measures. Bonuses and additional payments were given to medics, police, and other staff involved in COVID-19 prevention and treatment.

As the pandemic drags on, growth projections for all other economies in the subregion are revised down for 2020, but with some of them expected to recover more firmly in 2021 than earlier projected. Growth rates for Armenia, Azerbaijan, Georgia, the Kyrgyz Republic, and Tajikistan are expected to turn negative this year. Armenia and Georgia have been affected by deteriorating external demand caused by losses in tourism, net exports, and foreign direct investment, as well as lower remittances from the Russian Federation and reduced household incomes. In Tajikistan, an estimated 500,000 migrant workers—5.2% of the whole population were unable to return to work abroad at the start of the 2020 migrant work season because of rapidly falling oil prices in Q1 of 2020 and other negative impacts on the Russian Federation caused by COVID-19. In the Kyrgyz Republic, COVID-19 disrupted imports of raw materials, equipment, and food from the PRC and other major trade partners, and remittances are expected to fall with economic slowdowns in Kazakhstan and the Russian Federation. Despite the absence of officially reported COVID-19 cases, the economy of Turkmenistan has been hit hard by trade disruption and low oil and gas prices. Remittances into Uzbekistan are expected to decline until the beginning of 2021 as migrant workers are unable to travel to seasonal employment in the Russian Federation, and demand for export commodities remains weak throughout 2020. For Azerbaijan, this year’s growth projection turned negative mainly because of sluggish public and private investment, among other factors.

Link to the “Asian Development Outlook 2020 Supplement: Lockdown, Loosening, and Asia’s Growth Prospects”:

https://www.adb.org/sites/default/files/publication/612261/ado-supplement-june-2020.pdf

/// nCa, 19 June 2020