Predicting about the markets, particularly the oil and gas markets, falls in the genre of educated guess. The financial and analytical institutions are among the many sources for such predictions. The people in and related to the oil and gas sectors need to get acquainted with the incoming and fresh predictions to make their own informed decisions.

ING Bank, part of the ING Group, is an institution that regularly comments on financial and economic issues of wide concern. With a strong European base, the ING Bank has more than 85000 employees and serves around 38 million customers, corporate clients and financial institutions in over 40 countries. Its shares are listed in Amesterdam, Brussels, and New York.

On 19 December 2022, the ING Bank issued its ‘2023 Energy Outlook.’ Considerable research and work has gone into its preparation. However, like every other authoritative report of this kind, it cannot be used as the sole instrument for making any kind of decisions. This caveat is not meant, in no way, to take anything away from the value and worth of the ING Bank report.

The 2023 Energy Outlook (ING Bank Report) is available in pdf here:

https://think.ing.com/uploads/reports/Energy_Outlook_-_Dec_22.pdf

We are producing here a slightly summarized version of the first part of the report, dealing with the oil and gas markets:

The Russian oil exports have held up better than expected. This is partly because India, China and some smaller buyers increased their purchase of the Russian crude to avail the deep discounts. As a result, exports in October were 7.7 million barrels a day (MMbbls/d), down just one hundred thousand barrels per day (Mbbls/d) Year-on-Year (YoY).

However, the impact of the EU ban on Russian crude oil is still playing out, and we will have to wait until early February for the ban on Russian refined products. The ability of India and China to absorb a still more significant amount of Russian oil is likely limited.

As a result, we expect Russian supply to fall in the region of 1.6-1.8MMbbls/d Year-on-Year in the first quarter of 2023. As for the G-7 price cap, we expect it to have little direct impact on Russian oil supply for now, given that at US$60/bbl, it is above where Russian Urals are trading.

The de-escalation of the Russia-Ukraine war may not lead to the return of the pre-war oil trade flows but it would possibly remove a lot of supply risk from the market.

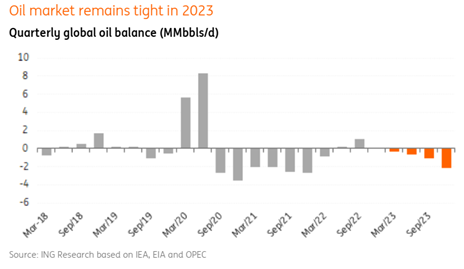

The decision of the OPEC+ to reduce output targets by 2MMbbls/d from November 2022 until the end of 2023 has been criticised, particularly by the Amcericans but with hindsight it appears to be a right decision because, at least in the near term, as it offers stability to the market. However, the cuts may prove to be more destabilising in the medium term, given the expectation of a tighter market through 2023.

Both oil and European gas prices may be off those highs we saw earlier in the year. Immediate gas supply worries have eased in recent months, although demand concerns are weighing on sentiment for oil. We do expect both markets to tighten again in 2023 and that, of course, suggests higher prices.

High energy prices, a gloomier macro outlook and China’s zero-Covid policy have all weighed on oil demand this year. At the beginning of 2022, global oil demand was expected to grow by more than 3MMbbls/d YoY and hit pre-Covid levels. However, demand is estimated to grow at a more modest 2MMbbls/d this year, leaving it below pre-Covid levels. While for 2023, demand is expected to grow in the region of 1.7MMbbls/d.

Almost 50% of this growth is expected to come from China with the expectation of an economic recovery.

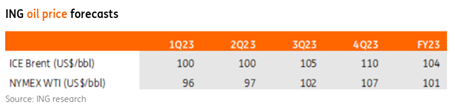

A combination of lower Russian oil supply and OPEC+ supply cuts means that the global oil market is expected to tighten over 2023. We expect a growing deficit over the course of the year, which suggests that oil prices should trade higher from current levels. We currently forecast ICE Brent to average US$104/bbl over 2023, but the uncertainty around our forecast is high given the geopolitical situation and the direction of the global economy.

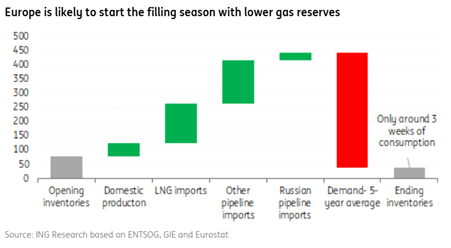

Of natural gas, given the circumstances, Europe could not have hoped for a better situation heading into this winter. Demand destruction and milder-than-usual weather in the early part of the heating season have ensured that the region has continued to build storage deeper into winter. EU storage continued to grow until mid-November, with it reaching nearly 96% full. This is above the five-year average of almost 88% for mid-November. This leaves Europe in a better-than-expected position for this winter and the next few months should be more manageable. However, it is still vital that the region remains cautious as Europe needs to try to end the current heating season with storage as high as possible given the expectation of a further reduction in gas flows next year.

Higher prices through much of this year have ensured demand destruction, and as a result, the European Commission has been able to stick to its voluntary demand cut of 15% between August and the end of March, rather than imposing a mandatory 15% reduction. Eurostat data shows that in September, EU natural gas demand was 15% below the five-year average, while numbers from third-party consultants suggest that in the months since, demand reductions have exceeded the 15% target.

Europe will need to see continued demand destruction through 2023 to ensure adequate supply for the 2023/24 winter. This is particularly the case given the risk that we see further declines in Russian gas supply to the EU.

Russian pipeline gas flows have fallen significantly this year. The latest data shows that Year-to-Date pipeline flows from Russia to Europe have fallen by around 50% YoY to roughly 58bcm. And, obviously, these flows have declined progressively as we have moved through the year with reduced output via Ukraine and Nord Stream. Daily Russian gas flows to the EU are down around 80% YoY at the moment. Therefore, if we assume that Russian gas flows remain at current levels through 2023, annual Russian pipeline gas to the EU could fall by a further 60% to around 23bcm in 2023. And clearly, there is a very real risk that the remaining flows will be halted.

The liquefied natural gas (LNG) market has helped Europe significantly this year. LNG imports into the EU over October grew by almost 70% YoY, with volumes exceeding 9bcm.

However, there are constraints to how much more LNG Europe can import due to limited LNG regasification capacity. However, we have seen the start-up of a fair amount of regasification capacity in the form of floating storage regasification units (FSRUs) over the second half of this year. The Netherlands, Germany, Finland & Estonia have – or are in the process of – starting up operations at these FSRUs with a combined capacity in the region of 23-27bcm. Germany is expected to bring a further 15bcm of regas capacity online early next year. This will help with some of the infrastructure constraints Europe is facing, but the issue is also around global LNG supply and the limited capacity, which is expected to start next year.

Global LNG export capacity was set to grow by around 19bcm in 2023, driven by the US, Russia and Mauritania. However, following Russia’s invasion of Ukraine and the sanctions which followed, it is likely that any ramping up of Russian capacity is surely on hold.

Russian capacity makes up for 46% of the total new capacity expected next year. Therefore, we could see just 10.5bcm of new supply capacity.The pace of inventory builds during the 2023 injection season will be much more modest compared to what we have seen this year, given the reductions in Russian supply. The ability of the EU to completely turn to other sources is just not possible. Therefore, Europe is likely to go into the 2023/24 winter with tight storage, which could leave the region vulnerable.

In order to get through the 2023/24 winter comfortably, we will have to see continued demand destruction once again. This will have to be either as a result of market forces or EU-mandated demand cuts. While Europe should be able to scrape through the 2023/24 winter if current Russian gas flows continue, it is much more challenging if remaining Russian gas flows come to a full stop.

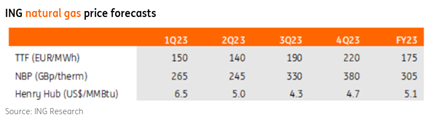

Therefore, we believe that there is upside to European gas prices in 2023. However, much will depend on how much storage the EU manages to draw down this winter.

The uncertainty around our gas price forecast is high given the geopolitical situation and the direction of the global economy.

In 2022 Europe not only faced a major gas crisis, it also had to cope with a broader power crisis. Yes, this was partly a result of what was going on in the gas market, but there are a number of other factors which have helped to see power prices skyrocket. /// nCa, 26 December 2022