CAREC has issued Energy Outlook Report 2030 for its member countries including Central Asia and the Caucasus, as well as their neighbours Mongolia, Pakistan and China.

According to the report, the energy demand in the CAREC region (excluding China) may grow by more than 30 percent by 2030

Energy consumption of natural gas is also expected to increase, reflecting its dominant position as a fuel for electricity generation and direct consumption in the residential and industrial sectors.

Hydropower is currently the largest source of renewable energy in the CAREC region, with more than 380 gigawatts (GW) of installed capacity as of 2019, including China, Tajikistan, Kyrgyzstan and Georgia, which rely heavily on hydropower.

The CAREC region (excluding China) needs about $340 billion in energy investment

Taking into account the size of the CAREC countries’ market and the need for infrastructure modernization, its need for energy investment by 2030 (excluding China) is estimated at 136-339 billion dollars.

If China is also included in this calculation, the investment needs of the region are estimated at 2.9-3.8 trillion dollars. These include investments in energy production and energy efficiency.

The complete report is available at this link: https://www.adb.org/sites/default/files/publication/850111/carec-energy-outlook-2030.pdf

Here we are producing the chapter related to Turkmenistan. It will be published in five parts. This is Part One.

Turkmenistan

Turkmenistan Highlights

- Natural gas plays a dominant role in Turkmenistan’s energy system. The country holds the fourth largest proven natural gas reserves in the world, with an annual production of more than 60 billion cubic meters (bcm). Gas is also the sole source of electricity generation.

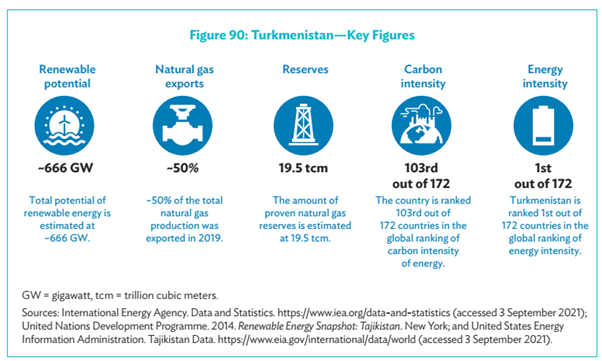

- Turkmenistan is a major energy exporter, as nearly half of its natural gas production is exported (Figure 90). The country also produces oil, nearly 40% of which is exported.

- Total installed power generation capacity in the country exceeds 7 gigawatts (GW). Recently, the government committed to introducing renewable energy technologies to its generation mix.

- Final energy demand in Turkmenistan is expected to reach 27.8 million tons of oil equivalent (toe) to 30.1 million toe in 2030, depending on the extent to which energy efficiency measures are implemented across various scenarios.

- Natural gas is expected to continue being a dominant source of electricity generation until 2030. Given the government’s plans to introduce renewable energy to the energy mix, the share of gas is, however, expected to decline in the long term.

- While renewable energy generation is one of the government’s key priorities, there is also a need for rehabilitating and modernizing its existing grid infrastructure.

- Energy sector investment needs range between $5.5 billion and $13.1 billion, depending on the scenario. Natural gas-powered generation accounts for the largest share of investment needs, given the country’s reliance on this resource.

- There are a variety of investment opportunities across Turkmenistan’s energy sector, including in renewable energy generation and sustainable fossil fuel production. However, further actions are required in order to remove market-entry restrictions.

- Policy recommendations for Turkmenistan include establishing further support for renewable power generation, improving the investment climate, implementing an infrastructure modernization program, and exploring the possibility of hydrogen production.

- The data sources used to develop the supply and demand, technology, carbon emissions, and investment outlooks for Turkmenistan include a number of publications by reputed institutions, including British Petroleum, the International Energy Agency, Fitch Solutions, and others. The full list of references is available at the end of this country study.

Energy Sector Profile

Country Profile

With a population of over 6 million people, Turkmenistan is one of the least densely populated countries in Asia. The country has experienced rapid growth in the past years, with a gross domestic product (GDP) annual growth rate of approximately 9% from 2010 to 2018. The coronavirus disease (COVID-19) pandemic has impacted the country significantly, due to a decrease in exports and pandemic-related measures. Nominal GDP decreased by 3% in 2020. However, the country is set to rebound quickly as its exports resume, leading to rapid economic growth (nominal GDP is expected to grow nearly 14% per annum until 2030) (Oxford Economics).

Blessed with one of the largest natural gas reserves in the world, Turkmenistan relies heavily on this resource as it covers a major part of the country’s energy demand, as well as its exports. Despite abundant potential for renewable energy (e.g., roughly 300 sunny days per year), the country’s sole energy generation source is natural gas (Figure 91). A long period of provision of free electricity and natural gas for a large share of the population (and low tariffs for those who pay) has led to low awareness for energy efficiency, which resulted in the country being ranked the most energy-intensive economy in 2018. However, the country is ranked 103rd out of 172 in terms of carbon intensity, due to the relatively small carbon footprint of natural gas power in comparison to other fossil fuels such as coal. /// nCa, 17 January 2023

To be continued . . .