Tariq Saeedi and Elvira Kadyrova

As we mentioned in the first part of this series, the diktat of geography is binding on all; there are no exceptions. This is an ever-present ground reality though its effect is not always the same; it can be kind and it can be cruel, it can be for you or it can be against you.

Within the context of geography, before we move any further, it is important to underline that when we say that TAPI is transforming into CAPS, we are not replacing the idea and elements of TAPI.

As a matter of fact, all the ground realities currently in motion are only strengthening the need and justification of every element of TAPI Corridor – the gas pipeline, possibly the oil pipeline too, the fiber optics link, the railway line, the motorway, the power transmission network, the access to deep water ports, the smooth, unhindered, speedy connectivity between the producers and consumers. These are the elements that define the TAPI Corridor, and they are magnifying as TAPI remodels into CAPS.

Also, when we say that TAPI is transforming into CAPS – Central-Asia-Pakistan-Seas – we are not hinting at the possibility of another Corridor. We are just describing the core geographic territory by assigning the name CAPS, making it obvious that the access to the warm waters is an integral part of the concept. It is for this reason that we prefer to describe Central Asia not as a landlocked region but as inland countries.

As the TAPI elements amplify in scope and importance, they are also claiming greater geographical spread. Therefore, the concept of CAPS is mobile and dynamic in nature. It wants to spread in all directions – all of South Asia, the entire Greater Central Asia, China, Russia, Europe, and seas, all of the seas of the world. This concept doesn’t want to be constricted or restricted by a name and it certainly doesn’t want to be called a corridor. It is just that – a concept.

Now, let’s look at some of the ground realities and the way they are transforming TAPI into CAPS.

Foremost among them is the situation in Ukraine. Apart from the massive humanitarian crisis it has created, the Ukraine situation has smashed globalization.

The trust among the nations and regions that is so necessary for the maintenance and growth of the globalization has been crushed; what is left is regionalization.

Much to the chagrin of certain analysts, the Ukraine situation has not affected Central Asia in any serious way but it has set in motion the consciousness of some ground realities.

We cannot encompass here the enormity of the regionalization that is taking place but we can certainly try to look at some of the related ground realities that are transforming TAPI into CAPS.

The first ground reality, emanating from the Ukraine situation, is that the Russian Gazprom has suffered a huge loss in its European gas market. For the near future, about 100-120 bcm of Russian gas is in search of new markets.

South Asia and China are the logical destinations.

In South Asia, let’s look at the gas market of Pakistan.

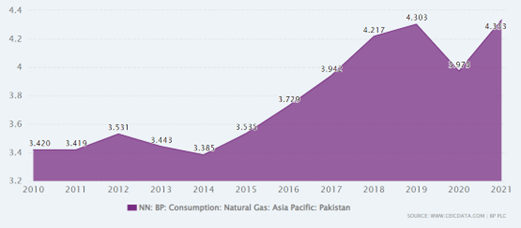

As the above graph shows, there has been huge growth in the gas consumption in Pakistan since 2014. The gas consumption in 2021 was nearly 44.8 bcm. The recent growth in the gas market of Pakistan has been more than 9% per annum, which is among the highest in the world.

However, if we look at the gas shortage and the way it has been stunting the business and industrial operations, and the massive rationing imposed on all consumers, it is estimated that the actual requirement of gas in Pakistan is nearly 90 bcm, perhaps close to 100 bcm.

Whenever this is brought up, the counter-argument is that the industrial and domestic consumers in Pakistan don’t have the capacity to pay more for the gas. This is an obsolete argument. The gas prices have increased several times during the past 15 years and the recent increase adds another 75% to the gas price, and yet the consumers are clamoring for more gas. Clearly, the price is not an issue when we look at the gas consumption capacity of Pakistan.

There is gas crisis in Pakistan; there is no doubt about that. At present Pakistan is groping ineffectually for internal cohesion but the handles are rather elusive. Nonetheless, this is not an existential crisis; the things would gel in due time and traction would be obtainable.

The past experience shows that whenever more gas becomes available, the industrial sector bounces back in Pakistan in less than 18 month, not only reclaiming the lost markets but capturing new ones.

The emerging scenario, thus, is that Pakistan can easily absorb the entire volume of TAPI i.e. 33 bcm, and the entire volume of the stalled IP (Iran-Pakistan gas pipeline) and would still have the space to accommodate about 20 bcm of the Russian gas.

So far, we have shown that Pakistan can be one of the destinations to accommodate nearly 20 bcm of the 100-120 bcm of the Russian gas. This is just the start of a very interesting story.

In the next part of this series, we will highlight the colossal possibilities offered by the letter S in CAPS. When the gas volumes reach the deep-sea port, there are so many things we can do with that. And, we are not talking of converting it to LNG. /// nCa, 27 February 2023

To be continued . . .