Economic growth in Asia and the Pacific is expected to remain solid, although risks to the outlook are rising, according to a report by the Asian Development Bank (ADB).

The region’s developing economies are forecast to grow 4.7% this year, a slight downward revision from a previous projection of 4.8%, according to Asian Development Outlook (ADO) September 2023, released today. The growth forecast for next year is maintained at 4.8%.

Growth in the region was upbeat in the first half of this year, driven by healthy domestic demand and reopening in the People’s Republic of China (PRC), even as a weaker global outlook reduced export demand. Rebounding tourism, resilient service sectors, healthy money transfers into the region, and improving financial conditions are all helping support economic activity, and inflation is receding in most economies after peaking last year.

However, weakness in the PRC’s property sector is weighing on regional prospects. High global interest rates have increased the risk of financial instability. Sporadic supply disruptions due to war in Ukraine, export restrictions, and the increased risk of droughts and floods caused by El Niño could once again trigger rising food prices and challenge food security.

“Developing Asia continues growing robustly, and inflation pressures are receding,” said ADB Chief Economist Albert Park. “Some central banks in the region have started to lower interest rates, which will help boost growth. Still, governments need to be vigilant against the many risks that the region faces. Property market weakness in the PRC remains a concern. Extreme weather events due to climate change and the effects of El Niño remind us that economies must work together to build resilience and protect the most vulnerable.”

Inflation in developing Asia and the Pacific is expected to be 3.6% this year, down from an earlier projection of 4.2%. This is largely due to low inflation in the PRC, along with steadying food and energy prices. The inflation forecast for next year is 3.5%.

Among developing Asia’s subregions, Southeast Asia’s growth outlook is cut to 4.6% this year from an earlier projection of 4.7%, due to weaker export demand. The forecast for South Asia is also lowered by 0.1 percentage points, to 5.4%—though it remains the fastest-growing subregion, thanks to strong investment and consumption. The outlook for East Asia is cut to 4.4% from 4.6%, with the PRC now expected to grow by 4.9% this year, from 5.0% in April. Growth forecasts have been raised for the Caucasus and Central Asia and for the Pacific.

In Caucasus and Central Asia, economic activity remained strong in the first half (H1) of 2023, driven by domestic demand, though growth slowed in every country except Kazakhstan and Tajikistan, compared to H1 2022. Inflation accelerated in Kazakhstan but slowed in the other seven countries as import prices stabilized, allowing some easing of monetary policy. The outlook remains dependent on external factors, including growth in key trade partners, oil prices, the pace of remittances and private transfers, and inflows of tourists and migrants from the Russian Federation.

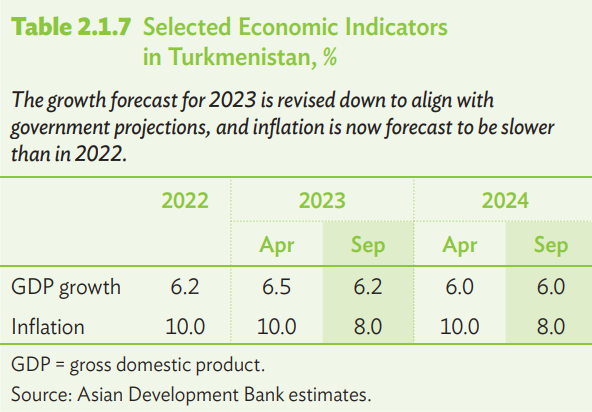

Here are some key points from chapter devoted to Turkmenistan:

Turkmenistan

- The government reported growth at 6.2% in the first half of 2023, slightly above 6.0% reported a year earlier.

- On the supply side, growth came from all sectors. Expansion in the large hydrocarbon economy came mainly from reportedly higher production and exports of natural gas, while the economy excluding gas and oil benefited from growth in construction, wholesale and retail trade, transport, and catering.

- Industry performance aside from hydrocarbons and construction reflected stable output in electricity, chemicals, textiles, food processing, and other agro-industrial products.

- Private firms engaged in import-substitution programs continued to receive substantial government support.

- According to half-year reports, strategic crops of cotton and wheat, as well as a large variety of horticultural produce, have been sown with the aim of meeting annual production targets.

- On the demand side, the government reported higher net exports and public investment in industrial and social infrastructure.

- The fiscal outlook remains dependent on revenue from hydrocarbon exports. The government aims to keep the state budget balanced in 2023 and 2024, benefiting from the positive outlook for energy exports.

- Growth in gas exports to the People’s Republic of China in the first half of 2023 is estimated to have been stable. More generally, higher demand for gas exports to the People’s Republic of China and other countries in the region may raise total exports in both 2023 and 2024.

Asian Development Outlook (ADO) September 2023 is available here:

https://www.adb.org/outlook/editions/september-2023

///ADB/nCa, 21 September 2023

#ADB, #ADBOutlook, #Turkmenistan, #economy, #CentralAsia