“Resilience in the global economy and easing global inflationary pressures are positive developments for economies in the Middle East and Central Asia. Overall growth is projected to strengthen to 2.8 percent in 2024 (from 2.0 percent in 2023) and 4.2 percent in 2025,” says the opening paragraph of the executive summary of the IMF Report ‘Regional Economic Outlook – Middle East and Central Asia,’ released on 18 April 2024.

The complete report is available from a link on this page:

Introducing the report to the media at a press conference in Washington DC on 18 April 2024, the Middle East and Central Asia Director of IMF, Jihad Azour, underlined some important points from the report:

First – An uneven recovery is expected among MENA and CCA economies amid high uncertainty. While inflation is receding in line with global trends in most countries, growth prospects are diverging between and within regions.

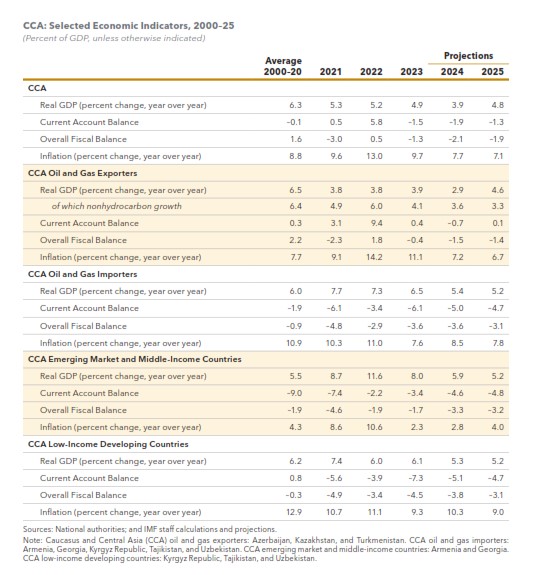

CCA – The CCA (Caucasus and Central Asia) economies exhibit continued resilience. Despite some moderation, growth is projected to remain robust at 3.9 percent in 2024 before picking up to 4.8 percent in 2025, owing in part to loosening macro policies, strong domestic demand, and idiosyncratic factors, such as oil production increases.

Over the medium term, growth is expected to remain relatively stable among oil importers, supported by strong domestic demand, while plateauing hydrocarbon production is projected to weigh on growth in oil exporters. In addition, trade diversion is reshaping trade in the CCA region. Following the onset of the war in Ukraine, countries in the CCA have seen a shift in the direction of their trade flows.

Second, inflation is receding in line with global trends.

In the CCA, the majority of countries inflation is below or close to targets, providing room for some countries to begin or continue monetary easing.

Inflation is forecast to ease from 7.7% in 2024 to 7.1% in 2025.

Third, vulnerabilities remain high, in a context of higher-than-usual uncertainties and elevated set of downside risks.

For CCA economies the main risks stem from a slowdown in trading partners and a worsening geoeconomic conditions related to the war in Ukraine.

Fourth – we need to balance policy priorities in uncertain times. Policymakers face the difficult task of safeguarding macroeconomic stability and debt sustainability while navigating geopolitical challenges and improving medium-term growth prospects.

- Monetary policy should remain vigilant, being cautious of premature or excessive easing. In addition, it is essential to strengthen monetary policy frameworks and increase the transparency while ensuring central bank independence.

- Given the differences in public sector debt levels, where debt levels are elevated, fiscal policy and active debt management would need to help bring them down decisively. That said, amid marked differences across countries, careful tailoring by country is essential.

- The heightened uncertainty should encourage countries accelerate reforms to fortify their fundamentals, including by strengthening institutions.

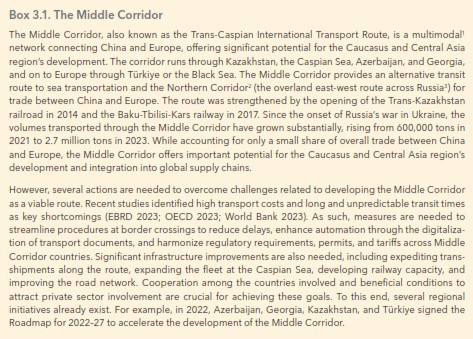

- In addition, potential opportunities from new trade corridors can be seized by reducing long-standing trade barriers, diversifying products and markets, and improving infrastructure.

* * *

Some passages, boxes, and tables from the report

The Caucasus and Central Asia region remains resilient to the war in Ukraine. Despite some moderation, growth is projected to remain robust at 3.9 percent in 2024 before picking up to 4.8 percent in 2025, owing in part to loosening macro policies, strong domestic demand, and idiosyncratic factors, such as oil production increases.

Over the medium term, growth is expected to remain relatively stable among oil importers, supported by strong domestic demand, while plateauing hydrocarbon production is projected to weigh on growth in oil exporters.

For the majority of Caucasus and Central Asia economies, inflation is below or close to targets, with most central banks easing monetary policy.

/// nCa, 22 April 2024