nCa Analysis

Turkmenistan and Iran signed a deal in the natural gas sphere on 3 July 2024. It consists of three components:

- Supply of 10 bcm (billion cubic meters) of gas a year to Iran as swap for supplying the same volume to Iraq

- Increase of gas supplies to Iran

- Construction by the Iranian companies the gas infrastructure in Turkmenistan including a 125km gas pipeline and three compressor stations

The arrangement for gas export to Iraq under swap through Iran was finalized on 8 November 2023 between the state concern Turkmengaz and the ministry of electricity of Iraq in Ashgabat. Iraq will mainly use the gas for power generation. According to the MoU, the commitment is for 5 years.

There are plans are to raise the supply of gas to Iran to 40 bcm. This, presumably, includes the 10 bcm of swap volume for Iraq and 1.5-2 bcm swap volume (unconfirmed yet) for Azerbaijan.

To accommodate these volumes, the sides will upgrade the Dovletabad–Serakhs–Khangeran segment. In this route, Dovletabad is the active field for the supply of gas, and Serakhs–Khangeran is the border point for transporting the gas to Iran where it would pass through the Chaloyuk gas measuring station.

The Dovletabad–Serakhs–Khangeran pipeline was inaugurated in January 2010. The length of the Turkmen section of the gas pipeline, which originates from the Dovletabad gas field in the south-eastern Turkmenistan, to the settlement Salyr Yap on the border with Iran is 30.5 km. The design capacity of the pipeline is to annually deliver 12.5 bcm.

Dovletabad–Serakhs–Khangeran was the second major gas pipeline between Turkmenistan and Iran.

The first was the Korpeje-Kurtkui pipeline which was opened in December 1997. The length of pipeline from the Turkmen gas field Korpeje to the Iranian city Kurtkui is 197 km, of which the length of the gas pipeline on the territory of Turkmenistan is 132 km. The capacity of this pipeline is 8 bcm.

Together, these two pipelines can carry up to 20 bcm of gas to Iran.

The current announcement that the supply volumes would be raised to 40 bcm means that a new pipeline system would be built.

There is a very small diameter pipeline at Lotfabad-Artyk point but it is insignificant.

* * *

On 1 March 2024, Ankara and Ashgabat signed two preliminary agreements for Turkmenistan to supply natural gas to Türkiye and Europe. A week later, the Turkish Minister of Energy and Natural Resources Alparslan Bayraktar told the media that three options for exporting Turkmen gas to Türkiye are on the table.

“One of them is that Turkmen gas is transferred to Türkiye through Iran via swap,” he said. “Another option is that it arrives in Türkiye by exchange through Iran and Azerbaijan. Alternatively, Turkmen gas could be supplied to Türkiye via a gas pipeline passing through the Caspian Sea.”

The Turkish official added that up to 2 billion cubic meters (bcm) of natural gas are planned to be transported at the initial stage.

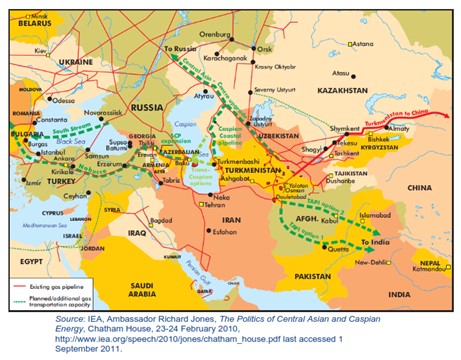

Present and planned gas pipelines in Central Asia

* * *

Agata Łoskot-Strachota and Adam Michalski wrote in an analysis published on 29 March 2024 by the Centre for Eastern Studies (OSW) of Poland:

Turkey is primarily interested in Turkmen gas because it has to diversify its sources of gas imports. For Ankara this is particularly important as the ability to procure gas from various suppliers, coupled with reducing its own gas consumption, would bring the country closer to its goal of establishing a hub for trading this resource.

In consequence, this would also position Turkey as an intermediary in dealings and transactions between suppliers from Eurasia and recipients in the EU.

Turkey’s demonstration of new ways to import gas from countries such as Turkmenistan may also be important for it in the context of upcoming talks on extending its existing gas contracts or signing new ones. This potentially includes the contract with Russia which expires in December 2025 (concerning deliveries via the Blue Stream route, up to 16 bcm annually), and/or the one with Iran which ends in July 2026 (along the Tabriz–Doğubayazıt route, up to 11.2 bcm annually).

Data from 2023 indicates that Ankara imported 21.1 bcm of gas from Russia and 5.4 bcm from Iran, accounting for 51.5% of its total gas imports in the previous year. The option of importing certain quantities of Turkmen gas may at least temporarily reduce the demand for gas from these sources and serve as an argument for negotiating more favorable delivery terms.

* * *

The swap deal for Iraq is an excellent example of geo-economic gumption.

Iraq is not a resource-poor country. It holds 112 trillion cubic feet (Tcf) (approx. 3.17 trillion cubic meters) of proven gas reserves, ranking 12th in the world and accounting for about 2% of the world’s total natural gas.

Because of the fact that its infrastructure was smashed to smithereens, it is unable to use its own gas for now. The supplies from Turkmenistan will help Iraq get back on its own feet. A prosperous and progressive Iraq would automatically contribute to the peace and stability of its neighbouring countries Iran, Jordan, Kuwait, Saudi Arabia and Syria,

Another aspect of this geo-economic gumption is that a similar swap arrangement via Iran and Türkiye could immediately bolster the energy security in Europe.

The construction of a pipeline through the Caspian Sea and onward by land from Azerbaijan to Türkiye for carrying the Central Asian gas to Europe would be expensive – according to some estimates its price tag could be in the vicinity of USD 20 billion. It would also take years to build the pipeline.

On the other hand, the Iranian AGAT pipeline system is immediately available and can instantly fill any gaps in the European gas requirements caused by the deletion of the Russian volumes.

The last part of a famous saying is: There are only permanent interests. /// nCa, 4 July 2024