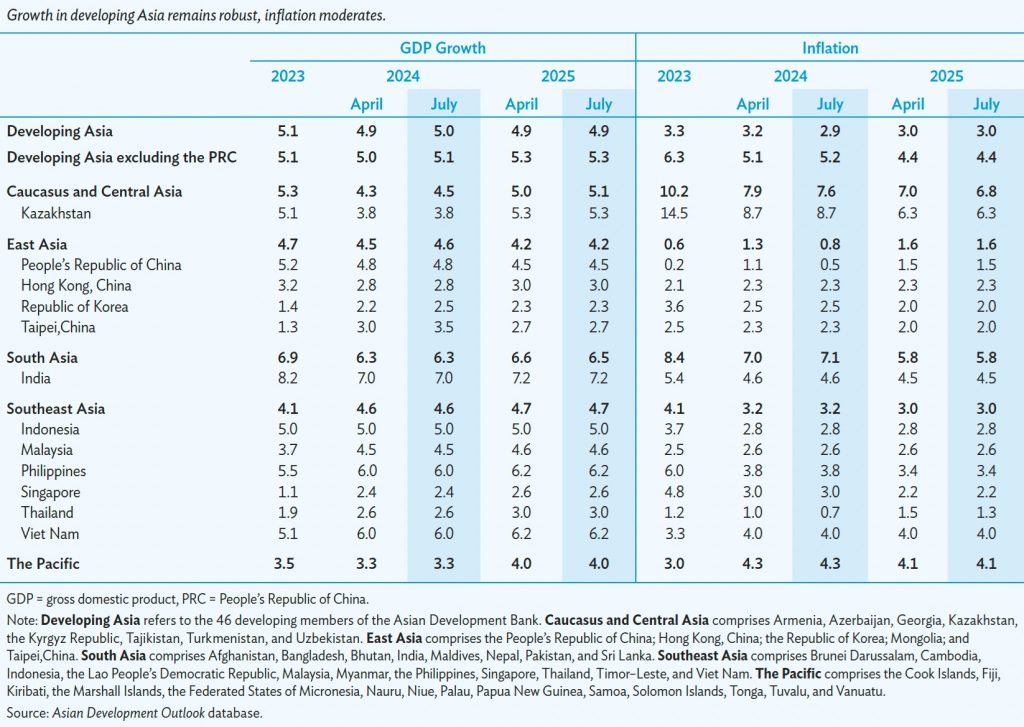

The Asian Development Bank (ADB) has slightly raised its economic growth forecast for developing Asia and the Pacific this year to 5.0% from a previous projection of 4.9%, as rising regional exports complement resilient domestic demand. The growth outlook for next year is maintained at 4.9%.

Inflation is forecast to slow to 2.9% this year amid easing global food prices and the lingering effects of higher interest rates, according to the latest edition of Asian Development Outlook (ADO), released today.

After a post-pandemic recovery that was driven mainly by domestic demand, exports are rebounding and helping propel the region’s economic growth. Strong global demand for electronics, particularly semiconductors used for high-technology and artificial intelligence applications, is boosting exports from several Asian economies.

“Most of Asia and the Pacific is seeing faster economic growth compared with the second half of last year,” said ADB Chief Economist Albert Park. “The region’s fundamentals remain strong, but policy makers still need to pay attention to a number of risks that could affect the outlook, from uncertainty related to election outcomes in major economies to interest rate decisions and geopolitical tensions.”

While inflation is moderating toward pre-pandemic levels in the region as a whole, price pressures remain elevated in some economies. Food inflation is still high in South Asia, Southeast Asia, and the Pacific, in part due to adverse weather and food export restrictions in some economies.

The growth forecast for the People’s Republic of China (PRC), the region’s largest economy, is maintained at 4.8% this year. A continued recovery in services consumption and stronger-than-expected exports and industrial activity are supporting the expansion, even as the PRC’s struggling property sector has yet to stabilize. The government introduced additional policy measures in May to support the property market.

The outlook for India, the region’s fastest-growing economy, is also unchanged at 7.0% for fiscal year 2024. India’s industrial sector is projected to grow robustly, driven by manufacturing and strong demand in construction. Agriculture is expected to rebound amid forecasts for an above-normal monsoon, while investment demand remains strong, led by public investment.

For Southeast Asia, the growth forecast is maintained at 4.6% this year amid solid improvements in both domestic and external demand. This year’s outlook for the Caucasus and Central Asia is raised to 4.5% from a previous projection of 4.3%, driven in part by stronger-than-expected growth in Azerbaijan and the Kyrgyz Republic. In the Pacific, the outlook for 2024 is maintained at 3.3% growth, driven by tourism and infrastructure spending, along with revived mining activity in Papua New Guinea.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. Established in 1966, it is owned by 68 members—49 from the region.

More details on situation in Caucasus and Central Asia from Asian Development Outlook:

The Caucasus and Central Asia growth forecast is revised up to 4.5% from 4.3% in 2024 and 5.1% from 5.0% in 2025, driven by stronger-than-expected growth in Azerbaijan and the Kyrgyz Republic. Azerbaijan’s economy expanded by 4.3% in January–April 2024, driven by transport and construction aided by public spending. The Kyrgyz Republic’s growth rate is estimated to have been 8.8% in Q1 2024 due to strong output in services and construction funded by domestic and foreign investment. Economic activity in other subregional economies has been similarly robust. Armenia grew by 9.2% in Q1 2024, led by growth in manufacturing. Georgia’s economy expanded by 9.0% in the first 4 months of 2024, as strong credit supported both domestic consumption and investment. Partly due to a sharp rise in exports, including gold sales, Tajikistan continued its strong growth, at the rate of 8.2% in Q1 2024. Growth in Turkmenistan is driven by public investment and net gas exports. A surge in fixed capital investment in Uzbekistan led to 6.2% growth in Q1 2024.

Growth prospects for Kazakhstan, the subregion’s largest economy, remain unchanged. In Q1 2024, the economy grew by 3.7%, supported mainly by construction, manufacturing, and services. This year, construction and manufacturing will remain the main drivers of economic growth. Government’s assistance to victims and reconstruction of damaged infrastructure after the worst floods in 30 years will sustain robust construction growth. The central bank’s consolidated business activity index showed business activities expanding in May 2024, supported by positive business sentiment as reported by the S&P Global’s manufacturing purchasing managers’ index. The mining is expected to make a sizable contribution to Kazakhstan’s medium-term growth after the completion of the Tengiz oil field expansion project in Q2 2025.

Inflation forecasts for 2024 and 2025 in the Caucasus and Central Asia are revised down. The revised forecast mostly reflects lower-than-expected price levels observed in Armenia, Georgia, and the Kyrgyz Republic. In Armenia, a strong local currency, among other factors, brought a 0.8% deflation in the first 5 months of 2024, a substantial decline from the 5.2% inflation in the same period of 2023. Amid currency appreciation, Georgia’s inflation for the first 5 months of 2024 was also limited to 0.9%. In the Kyrgyz Republic, inflation dropped to 4.6% in May 2024, primarily reflecting price movements of major commodities, from 11.3% a year ago. Inflationary pressures are also subsiding in other economies of the subregion. In January–May 2024, Kazakhstan’s inflation rate slowed to 9.0%, down from 18.5% in the same period in 2023, due to a stable exchange rate and relatively tight monetary policy. Tajikistan’s inflation was 3.8% in the first 4 months of 2024. In Uzbekistan, inflation decelerated to 9.2% in the first 5 months of 2024 from 11.4% a year earlier. ///ADB, 17 July 2024