Tariq Saeedi

The BRICS summit will be held in Kazan, Russia, 22-24 October 2024. Three major announcements are expected. One of them is the launch of the BRICS Pay, an alternative system aimed at de-dollarization.

Blockchain-based, it could possibly be one of the biggest geopolitical and economic developments of recent years. Moreover, it will operate as the global south’s answer to the SWIFT payment system. Specifically, it would allow the nations to conduct increased bilateral trade in local currencies.

The planned mechanism was earlier called BRICS Bridge. Perhaps the change of the name is part of the process of refining the idea.

Melissa Pistilli, in an article published by the Investing News Network (INN) on 8 July 2024, has commented on the issue.

How Would a New BRICS Currency Affect the US Dollar?

https://www.nasdaq.com/articles/how-would-new-brics-currency-affect-us-dollar-updated-2024

Here are some passages from the article of Ms. Pistilli:

Will BRICS have a digital currency?

BRICS nations do not as of yet have their own specific digital currency, but a BRICS blockchain-based payment system is in the works, according to Kremlin aide Yury Ushakov in March 2024. Known as the BRICS Bridge multisided payment platform, it would connect member states’ financial systems using payment gateways for settlements in central bank digital currencies.

The planned system would serve as an alternative to the current international cross-border payment platform, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system, which is dominated by US dollars.

“We believe that creating an independent BRICS payment system is an important goal for the future, which would be based on state-of-the-art tools such as digital technologies and blockchain. The main thing is to make sure it is convenient for governments, common people and businesses, as well as cost-effective and free of politics,” Ushakov said in an interview with Russian news agency TASS.

What would the advantages of a BRICS currency be?

A new currency could have several benefits for the BRICS countries, including more efficient cross-border transactions and increased financial inclusion. By leveraging blockchain technology, digital currencies and smart contracts, the currency could revolutionize the global financial system. Thanks to seamless cross-border payments, it could also promote trade and economic integration among the BRICS nations and beyond.

How would a new BRICS currency affect the US dollar?

The potential impact of a new BRICS currency on the US dollar remains uncertain, with experts debating its potential to challenge the dollar’s dominance. However, if a new BRICS currency was to stabilize against the dollar, it could weaken the power of US sanctions, leading to a further decline in the dollar’s value. It could also cause an economic crisis affecting American households. Aside from that, this new currency could accelerate the trend toward de-dollarization.

Nations worldwide are seeking alternatives to the US dollar, with examples being China and Russia trading in their own currencies, and countries like India, Kenya and Malaysia advocating for de-dollarization or signing agreements with other nations to trade in local currencies or alternative benchmarks.

However, a recent study by the Atlantic Council’s GeoEconomics Center released in June 2024 shows that the US dollar is far from being dethroned as the world’s primary reserve currency. “The group’s ‘Dollar Dominance Monitor’ said the dollar continued to dominate foreign reserve holdings, trade invoicing, and currency transactions globally and its role as the primary global reserve currency was secure in the near and medium term,” reported Reuters.

Ultimately, the impact of a new BRICS currency on the US dollar will depend on its adoption, its perceived stability and the extent to which it can offer a viable alternative to the dollar’s longstanding hegemony.

* * *

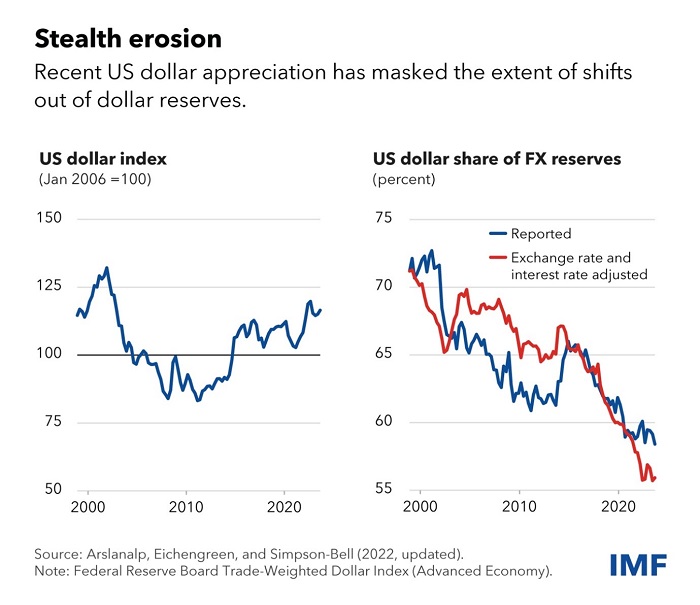

The US Dollar will not collapse but it will keep ceding space to other currencies. An IMF blog authored by Serkan Arslanalp, Barry Eichengreen , and Chima Simpson-Bell, and published at the IMF website on 11 June 2024, dilates on this conclusion.

Dollar Dominance in the International Reserve System: An Update

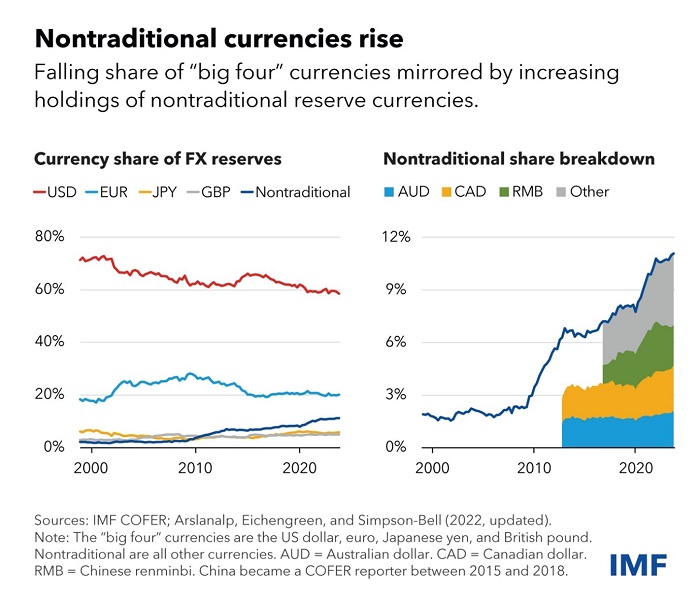

The blog says, “Recent data from the IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) point to an ongoing gradual decline in the dollar’s share of allocated foreign reserves of central banks and governments. Strikingly, the reduced role of the US dollar over the last two decades has not been matched by increases in the shares of the other “big four” currencies—the euro, yen, and pound. Rather, it has been accompanied by a rise in the share of what we have called nontraditional reserve currencies, including the Australian dollar, Canadian dollar, Chinese renminbi, South Korean won, Singaporean dollar, and the Nordic currencies. The most recent data extend this trend, which we had pointed out in an earlier IMF paper and blog.”

“These nontraditional reserve currencies are attractive to reserve managers because they provide diversification and relatively attractive yields, and because they have become increasingly easy to buy, sell and hold with the development of new digital financial technologies (such as automatic market-making and automated liquidity management systems),” says the IMF blog.

“One nontraditional reserve currency gaining market share is the Chinese renminbi, whose gains match a quarter of the decline in the dollar’s share. The Chinese government has been advancing policies on multiple fronts to promote renminbi internationalization, including the development of a cross-border payment system, the extension of swap lines, and piloting a central bank digital currency. It is thus interesting to note that renminbi internationalization, at least as measured by the currency’s reserve share, shows signs of stalling out. The most recent data do not show a further increase in the renminbi’s currency share: some observers may suspect that depreciation of the renminbi exchange rate in recent quarters has disguised increases in renminbi reserve holdings. However, even adjusting for exchange rate changes confirms that the renminbi share of reserves has declined since 2022,” notes the blog.

* * *

Central Asia is definitely watching attentively the changing pattern of the global currency mix. There is no urge to cut and run but the banking systems in the region are diversifying in line with the emerging trends.

Almost all of the countries in the broader region are inclined to deal in the mutual currencies.

Some countries have added yuan to the list of traded and convertible currencies alongside the US dollar and the Euro.

The recently opened International Trade Centre at the border of Uzbekistan and Afghanistan allows trading in five currencies including the yuan.

With three of the five countries of Central Asia willing to join the BRICS, it is logical that the soon-to-be-launched BRICS currency and/or gateway system would reflect in their interaction with the foreign currencies, most notably the US dollar. — The region would not ditch dollar but would not cling stubbornly to it either. /// nCa, 10 September 2024 [CONCLUDED.]