E-commerce in 2025: Trends, Challenges, and Innovations

The e-commerce landscape is constantly evolving, with new trends, challenges, and innovations shaping the way we buy and sell online. Here’s a look at some of the key developments in the e-commerce world:

1. The Rise of AI-Powered Shopping

Artificial intelligence (AI) is rapidly transforming the e-commerce experience. AI-powered chatbots are providing personalized customer service, while AI-driven recommendation engines are helping shoppers discover new products.

OpenAI’s Operator: The recent launch of OpenAI’s Operator, an AI agent with e-commerce applications, signals a new era of agentic shopping. This technology could revolutionize how we interact with online stores, allowing for more natural and conversational shopping experiences.

2. The Battle for Quick Commerce Dominance

The quick commerce sector is heating up, with companies like Blinkit, Zepto, and Delhivery vying for market share. These companies are focused on delivering groceries and other essentials within minutes, catering to the growing demand for instant gratification.

Blinkit’s Expansion: Despite facing intense competition, Blinkit is expanding its network of dark stores to reach more customers and offer faster delivery times.

Delhivery’s Rapid Commerce: Delhivery is entering the quick commerce arena with its Rapid Commerce service, aiming to provide efficient delivery of fast-moving consumer goods.

3. The Importance of Logistics and Fulfillment

As e-commerce continues to grow, logistics and fulfillment are becoming increasingly critical. Companies are investing in their supply chains and exploring new technologies to ensure timely and cost-effective delivery.

3PL Providers: E-commerce companies are increasingly relying on third-party logistics (3PL) providers to streamline operations and reduce costs.

Local Warehouses: Marketplaces like Temu are establishing local warehouses to facilitate faster shipping and improve the customer experience.

4. The Growing Focus on Sustainability

Consumers are becoming more environmentally conscious, and e-commerce companies are responding by adopting sustainable practices. This includes reducing packaging waste, optimizing delivery routes, and supporting eco-friendly brands.

Gelato’s On-Demand Printing: Gelato’s on-demand print production model helps reduce reliance on centralized mass production, minimizing supply chain challenges and lowering emissions.

5. The Evolving Regulatory Landscape

Governments around the world are paying close attention to the e-commerce industry, introducing new regulations to protect consumers and ensure fair competition.

Marketplace Regulations: Marketplaces are facing increased scrutiny, with concerns being raised about issues like dark patterns and the use of consumer data.

Challenges and Opportunities

While the e-commerce industry is booming, it also faces several challenges. These include:

Cybersecurity Threats: Online retailers need to be vigilant in protecting themselves and their customers from cyberattacks, especially during peak shopping seasons.

Data Privacy: Concerns about data privacy are growing, and e-commerce companies need to be transparent about how they collect and use customer data.

Competition: The e-commerce market is becoming increasingly competitive, and companies need to innovate and differentiate themselves to succeed.

Despite these challenges, the e-commerce industry offers tremendous opportunities for growth and innovation. By embracing new technologies, focusing on customer experience, and prioritizing sustainability, e-commerce companies can thrive in this dynamic and ever-evolving landscape. [nCa-AI collaborative]

E-Commerce in Central Asia: Challenges and Prospects of Digital Transformation

The development of e-commerce in Kyrgyzstan, Tajikistan and Uzbekistan can become a key factor in the fight against poverty and stimulating economic growth. Despite geographical isolation, the countries of Central Asia are gradually integrating into global trade processes using digital technologies.

The e-commerce sector has seen significant growth in recent years. Global e-commerce sales are expected to reach $30 trillion in 2023, opening up new opportunities for entrepreneurs in the region. According to the World Bank, digital trading platforms play an important role in expanding opportunities for small and medium enterprises, agricultural producers, and women entrepreneurs, enabling them to access national and international markets.

Potential and challenges of digital trade

E-commerce can reduce trade costs by eliminating intermediaries and increasing the efficiency of supply chains. This is especially important for landlocked countries such as Kyrgyzstan, Tajikistan, and Uzbekistan, where logistical barriers limit competitiveness. However, the successful development of e-commerce in the region faces a number of systemic challenges.

Key obstacles include weak infrastructure, low levels of digital literacy, underdeveloped online payment systems, and legal barriers. According to the World Bank, despite the existence of a regulatory framework, e-commerce regulation remains fragmented, which hinders the sector’s growth.

E-Commerce Growth and Key Players

In 2024, Uzum, Uzbekistan’s largest marketplace, became the country’s first tech unicorn, reaching a valuation of over $1 billion. In addition to national platforms, international companies such as eBay and NOVICA are active in the region, expanding local producers’ access to the global market.

The development of e-commerce is also supported by traditional industries. In particular, textile production, agriculture and the tourism sector are increasingly using digital channels to attract customers and export products.

Systemic solutions are needed

However, despite the positive trends, the e-commerce market in Central Asia remains small, estimated to be less than US$3 billion. Low trust in digital financial instruments, limited logistics, and underdeveloped internet infrastructure remain major challenges.

The formation of a single digital market in Central Asia would remove barriers and improve the sector’s efficiency. However, this requires coordination of efforts by governments, businesses, and international organizations.

Prospects and steps forward

Unleashing the full potential of e-commerce in the region requires investment in digital literacy, improved logistics solutions, and harmonized legislation. International financial institutions and donors are already implementing a number of programs to support e-commerce, but their impact remains limited due to fragmented initiatives.

According to the World Bank, comprehensive measures including developing payment infrastructure, supporting online platforms, and creating a favorable environment for digital entrepreneurs could be key to economic growth and poverty reduction in the region. E-commerce in Central Asia is still in its infancy, but with the right support, it could become a catalyst for transforming the regional economy. [FinTech & Retail, 27 January 2025]

E-Commerce Development Trends in Central Asia through the Eyes of Wildberries

Denis Semenkov , Director of the Wildberries Department for Work in the CIS Countries , tells the Fintech & Retail Central Asia portal about the current level of eCom development in the countries of Central Asia and the most indicative results at the end of 2024 .

The e-commerce market has shown rapid growth rates in recent years not only in Central Asia but also globally. Global digitalization of society, which is manifested in the penetration of the Internet, its increased speed, the spread of smartphones and consumer habits of online shopping are the main factors in the development of online retail.

According to eMarketer, the global eCommerce market will reach 20.1% growth (over $6 trillion) in 2024, and almost 23% by 2028.

Against the backdrop of global eCom growth, online sales are rapidly gaining popularity in Central Asian countries. At the same time, both local players and large international platforms that have entered the regional market with large investments and an attractive business model for local entrepreneurs and buyers are developing.

Of course, the trends in eCom development in 2024 in the countries of Central Asia include the penetration of the Internet and online services for the population, the improvement of national payment systems and financial instruments, as well as an increase in investment in logistics and warehouse infrastructure.

The markets of the Central Asian region, despite the geographical proximity of the countries included in it, differ in country characteristics, specific legislation and the level of digitalization of services.

According to analysts, Kazakhstan is one of the countries with the most promising eCom growth. According to the results of a PwC study, the retail e-commerce market in Kazakhstan showed a 61% growth in the first 6 months of 2024 (by the end of 2023, the market volume grew by 79%), and its share in the total retail trade in the country was 16.6%. At the same time, the share of marketplace sales is 89%.

According to the National Agency of Promising Projects of the Republic of Uzbekistan, the volume of the e-commerce market in Uzbekistan in 2023 exceeded $1 billion, which is about 4% of the total retail trade. At the same time, analysts predict growth of up to 15% in the next five years.

The total volume of the eCom market in Kyrgyzstan in 2024 was about $360 million. According to the E-Commerce Association of the Kyrgyz Republic, the growth rate in e-commerce in the country has doubled over the past two years, and according to analysts’ forecasts, it will grow to $595 million by 2028. The development of the industry has led to an increase in non-cash payments in Kyrgyzstan, as well as a significant increase in the export of local products on online platforms, especially textiles.

At the same time, the drivers of eCom growth in the region are not only the active role of marketplaces and competition between local and international platforms, but also the involvement of the state in creating conditions for business growth in the online environment, regulating the e-commerce market, expanding financial and payment instruments, which affects the inflow of investment in improving the logistics infrastructure of Central Asian countries.

WB is a platform for the growth of hundreds of thousands of entrepreneurs. At the same time, there is a huge potential in meeting consumer demand in the CIS countries, especially in Central Asia. The company is developing the markets of the countries where it operates in several areas. In particular, it is working on developing infrastructure and taking warehouse logistics for local players to a new level, promoting the expansion of territories covered by the delivery of goods, and helping entrepreneurs earn money together with Wildberries.

Industries Most Successful for Online Trading Development

Sales volumes in Central Asia are growing rapidly. We see how local entrepreneurs are increasingly trying to promote their products online, gaining access to a wide audience of buyers and the opportunity to optimize the costs of storing and delivering their goods due to the wide opportunities of Wildberries.

At the same time, more and more consumers prefer online shopping. Due to the increasing number of sellers and increased competition on marketplaces, buyers have the opportunity to purchase goods at favorable prices and with significant discounts.

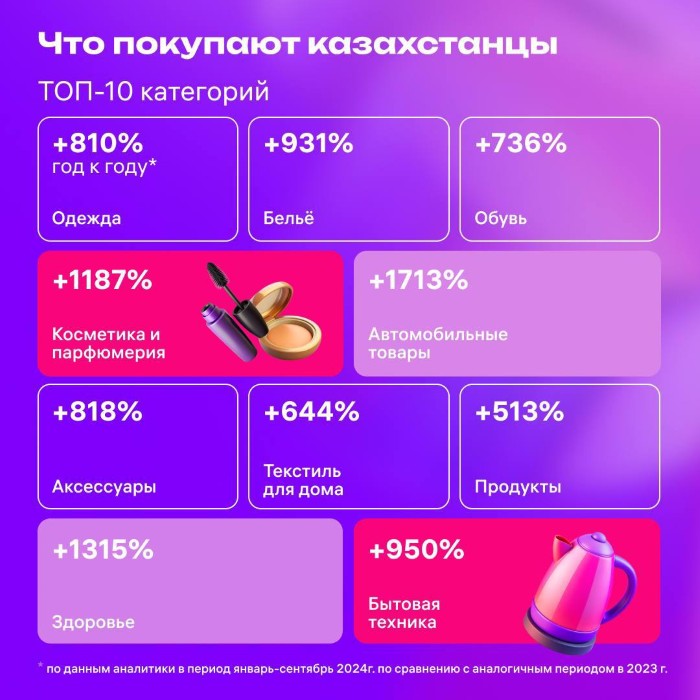

The greatest demand among buyers on the platform is for clothing and footwear, cosmetics and baby products, food and household goods, as well as electronics and building materials.

In relation to Central Asia, we see a huge demand for textile products manufactured in Uzbekistan and Kyrgyzstan. The demand for local traditional products is also growing rapidly: clothing, dishes, shoes and accessories.

According to our analytical service, over the first 9 months of 2024, both the sales figures of local entrepreneurs on the site and the purchases of residents of Kazakhstan, Kyrgyzstan and Uzbekistan have grown significantly.

Development of eCom in various Central Asian countries

| Country (Wildberries entry into the market) | Local Seller Sales for 9 Months 2024* | Purchases of the country’s residents for 9 months of 2024: |

| Kazakhstan (since 2014) | + 67.06% year-on-year | +96% |

| Kyrgyzstan (since 2017) | + 113% | +131% |

| Uzbekistan (since 2022) | 87 times more | +47% |

*according to analytics in monetary terms for the period January-September 2024 compared to the same period in 2023.

Kazakhstan

In terms of sales volume and the number of local entrepreneurs presenting their products on Wildberries, Kazakhstan has been ranked 3rd after Russia and Belarus among all countries where the company operates for several years in a row. Thus, in the first 9 months of 2024, sales in the republic increased by 67% compared to 2023.

Wildberries is actively developing its logistics business in all countries where it operates, increasing warehouse areas and expanding the network of order pick-up points. For example, in Kazakhstan in 2024 the company will have over 43 thousand square meters of warehouse space in 7 major cities.

The construction of two large logistics hubs of the company in the Almaty region and Astana with a total area of about 269 thousand square meters is also ongoing: the first stages will be commissioned in 2025. The new Wildberries facilities will create employment opportunities for 10 thousand people and will increase the speed of delivery to customers both within the republic and in all countries where the company operates.

Uzbekistan

Wildberries continues to actively develop the export potential of Uzbek producers and creates conditions for scaling local business in the online segment. Sales of Uzbek entrepreneurs on the platform for 9 months of 2024 increased by 87 times (!) compared to the same period in 2023 (in monetary terms).

The most popular products made in Uzbekistan among buyers on the platform are still clothing and home textiles. The sales dynamics of T-shirts amounted to +40% growth year-on-year*, bath towels – +35%, pajamas – +40%, long sleeves – +49%, tracksuits – +34% and bed linen – +112%. Residents of Russia buy the most textile products from Uzbekistan on the platform: in monetary terms, over the first 9 months of 2024, clothing sales grew by 66%, and home textiles – by 75%.

Clothing exports to other countries where Wildberries operates have also increased. Sales of Uzbek goods in Belarus have grown by 124% year-on-year, in Kazakhstan (+140%), in Kyrgyzstan (+192%) and in Armenia (+23%).

Kyrgyzstan

There is also an increase in the number of entrepreneurs in Kyrgyzstan (+125% in 9 months of 2024) and an increase in sales by 113% in monetary terms compared to last year.

The dynamics of export of locally produced goods to the countries where Wildberries operates is growing: 7.5 times in monetary terms over the first 9 months of 2024. During this period, demand for local products on the site among residents of Belarus increased by 816% in monetary terms year-on-year, in Kazakhstan – by 730%, in Russia (+648%), in Uzbekistan (+427%) and in Armenia (+376%).

The highest share of exports of light industry goods from Kyrgyzstan still belongs to Russia. Thus, in the first 9 months of 2024, Russians purchased 8.2 times more clothes from Kyrgyzstan than last year. At the same time, the export of sportswear increased 6 times, accessories – 8.3 times, underwear – more than 10 times, and headwear – 6 times.

Thus, we see an increase in the export of locally produced goods and an increasing interest of entrepreneurs in online sales. This allows local entrepreneurs to expand their sales markets and grow, freely competing even with large brands on the platform.

Positions of local eCom players and international platforms

In Kazakhstan and Uzbekistan, local marketplaces have been actively growing for several years in a row, creating confident competition for international players in their countries. For example, by the end of 2023, Kaspi and Wildberries together accounted for over 50% of all eCom sector volumes in Kazakhstan (according to the Agency for the Protection and Development of Competition of the Republic of Kazakhstan).

This growth of national players and the entire eCom industry in Central Asian countries is due to several factors: an increase in the share of Internet users and the popularity of online shopping via smartphone, government support measures and the emergence of large investors and international marketplaces on the market, with their own logistics infrastructure and fintech services.

Among the strengths of local online trading players in the region, it is worth noting:

- knowledge of the local market and a deep understanding of consumer preferences and habits of the population;

- adaptation and application of our own fintech services: purchases in installments, etc.;

- fast delivery within the country . Local marketplaces offer shorter delivery times for goods thanks to a developed network of couriers and their own pick-up points.

The weaknesses of local players include:

Limited product range . While international online platforms offer a wide range of products in all categories, local players have a limited product range, especially in certain categories such as home appliances, household goods, clothing, etc.;

higher prices on local marketplaces due to the limited range of products and brands.

It is important to note that the battle for consumers continues, and each side must adapt to changing market conditions and demands. Competition between local and international players is expected to intensify in the coming years, which will generally result in increased investment in warehouse infrastructure and improved logistics processes in the region.

Key Challenges of the Central Asian E-Commerce Market

In general, eCom in Central Asian countries is reaching a new level today: more choice – more demand – a highly competitive environment. And, as a result, new challenges arise for all participants in this market:

For marketplaces, this includes the implementation and improvement of fintech services, working with feedback and suggestions to improve customer service, including in local languages, as well as the development of human resources and professional skills.

For entrepreneurs, this means improving the quality and uniqueness of goods, increasing the level of knowledge and competence of employees, and opening up new markets in new countries.

For national governments and public authorities : the rapid development of e-commerce requires the adaptation of legislative features in the participation of financial services and customs procedures to the needs and development trends of the industry.

For local businesses , there is a need to invest in the development of their own production, increase export capacity within the CIS and neighboring countries, and develop the Central Asian region as a whole. [FinTech & Retail, 15 January 2025] /// Compilation, Prompt Engineering and Human Input by nCa, 31 January 2025