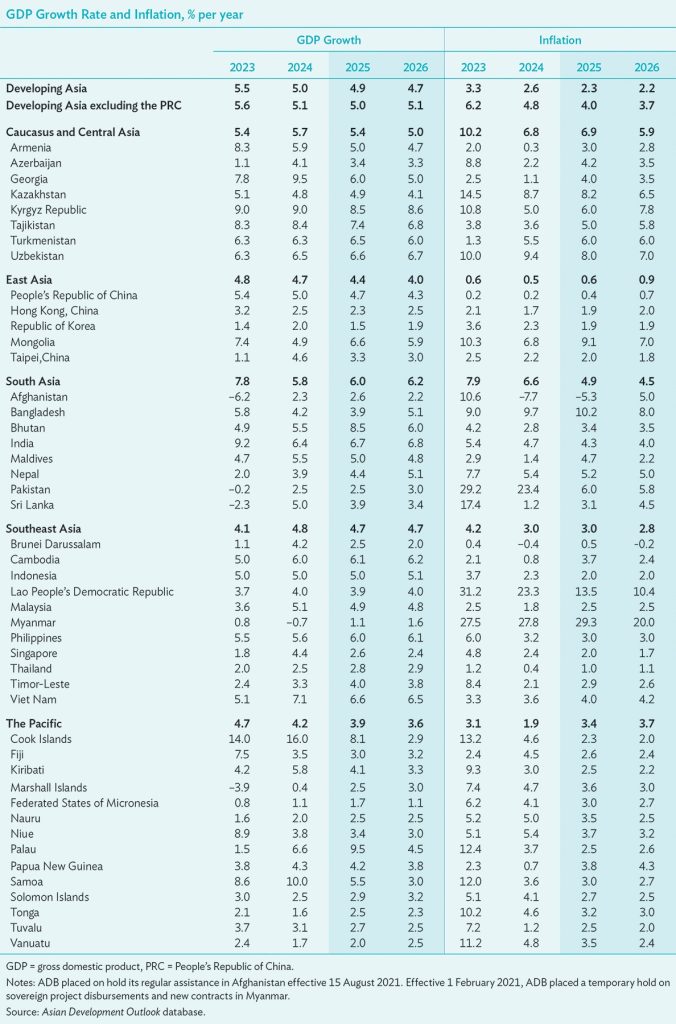

Economies in developing Asia and the Pacific are projected to grow 4.9% this year, down from 5.0% last year, according to the latest forecast by the Asian Development Bank (ADB).

Solid domestic demand and strong global appetite for semiconductors driven by the artificial intelligence boom are supporting growth, but tariffs and trade uncertainty will act as a headwind. Regional growth is expected to decline further to 4.7% next year, according to Asian Development Outlook (ADO) April 2025, released today. Inflation is projected to moderate to 2.3% this year and 2.2% next year as global food and energy prices continue to decline.

The growth forecasts were finalized prior to the 2 April announcement of new tariffs by the US administration, so the baseline projections only reflect tariffs that were in place previously. However, ADO April 2025 does feature an analysis of how higher tariffs may affect growth in Asia and the Pacific.

The report notes that while economies in the region are resilient, faster and larger-than-expected changes in US trade and economic policies pose risks to the outlook. Along with higher US tariffs, increased policy uncertainty and retaliatory measures could slow trade, investment, and growth.

“Economies in developing Asia and the Pacific are supported by strong fundamentals, which are underpinning their resilience in this challenging global environment,” said ADB Chief Economist Albert Park. “Rising tariffs, uncertainties about U.S. policy, and the possibility of escalating geopolitical tensions are significant challenges to the outlook. Asian economies should retain their commitment to open trade and investment, which have supported the region’s growth and resilience.”

Further deterioration in the property market of the People’s Republic of China (PRC), the region’s largest economy, could also drag on growth. ADB projects a 4.7% expansion for the PRC this year, and 4.3% next year, compared with 5.0% last year.

Stronger growth in South Asia and Southeast Asia, driven by domestic demand, and a continued recovery in tourism elsewhere in the region will partly offset the slowdown in the PRC. India—South Asia’s largest economy—is projected to grow by 6.7% this year and 6.8% next year. Economies in Southeast Asia are forecast to grow by 4.7% this year and next year.

Weak external demand is expected to weigh on economic activity in Caucasus and Central Asia, with growth projected to slow from 5.7% last year to 5.4% this year and 5.0% next year. For the Pacific, tourism will continue to support growth but at a slower pace, which is forecast at 3.9% this year and 3.6% next year, compared to 4.2% last year.

Here are some excerpts from Asian Development Outlook April 2025, devoted to Turkmenistan:

Growth is projected to rise slightly in 2025 before moderating in 2026, reflecting projected changes in hydrocarbon production and government spending. Faster credit growth, increased public spending, and an expected rise in import prices are projected to raise inflation slightly in 2025 and 2026. The economy would benefit from more complex exports with higher value added.

Economic performance

The government reported sustained growth at 6.3% in 2024, with moderate hydrocarbon production and exports and substantial public investment. On the supply side, the government noted expansion in various sectors, with industry and services the main growth drivers.

Industry excluding construction was reported to grow by 1.5%, reflecting moderate expansion in production of crude oil, oil products, chemicals, and electricity, as well as processed food, building materials, and textiles.

Construction was reported to grow by 11% on a notable increase in capital investment. This influx of funds supported construction projects across the country, including the development of new industries, the introduction of innovative technologies, and a substantial amount of housing, with 1.45 million square meters of housing completed in 2024 and construction of the second stage of the “smart city” of Arkadag.

Construction benefited from the creation of 5,735 new jobs, which helped to boost productivity and project completion rates.

Agriculture grew by 5.3% thanks to higher production of cotton, wheat, and horticulture. Services expanded by 8.6%, driven mostly by gains in transport and communications (7.2%), trade (10.1%), and other services.

Public investment and net exports were the main contributors to growth on the demand side. The volume of gross investment in various production facilities and social infrastructure under the President’s program for socioeconomic development in 2022–2028 was reported to increase by 9.1%. Rising volumes of natural gas, Turkmenistan’s main export, boosted net exports.

Economic prospects

The President’s socioeconomic development program for 2022–2028 guides Turkmenistan’s economic development over the medium term. Ensuring macroeconomic stability is a key priority. The program calls for diversifying the economy through greater variety in domestic production and exports, expanding the role of the private sector, developing innovative industries, digitalizing the economy, boosting regional trade integration, and gradually moving to a greener economy through greater cooperation with the international community. Additional measures are expected to meet infrastructure and social concerns, with more efforts to attract foreign direct investment.

The government has approved its comprehensive Program for Socioeconomic Development for 2025. The program aims to maintain stable economic growth across sectors through continued public investment in infrastructure, including in oil and gas, and economic diversification achieved by developing transport infrastructure, agriculture, and the economy outside of industry. Growth is expected to be supported by strong gas exports and increased consumer spending. Key goals include creating over 3,000 new jobs, increasing foreign trade turnover to $20 billion, and boosting the share of the nonstate sector in GDP to 71.6%. GDP growth is projected at 6.5% in 2025 and 6.0% in 2026.

Several key activities are expected to drive Turkmenistan’s economic growth in the coming years. In the hydrocarbon sector, these include the development of major gas fields, such as the Galkynysh field; progress in building the Turkmenistan– Afghanistan–Pakistan–India gas pipeline; and facilities for gas-swap exports to Iran, Iraq, and Türkiye. In construction, continued investment in social and cultural infrastructure will play a crucial role, as will the modernization of transport networks, including railways.

Initiatives in agriculture will focus on cotton and grain production, livestock rearing, and the integration of modern technology. In trade, efforts will be made to ensure market stability, food security, and commodity abundance. Further, the government will continue to support state-owned enterprises and private firms engaged in import substitution and export promotion programs.

Strong revenues from hydrocarbons and other sources are projected to keep the state budget near balance in 2025 and 2026. While financing for public investment projects will remain large, with the bulk of it coming off budget, public debt is projected to decrease further, to 2.6% of GDP by the end 2026.

Turkmenistan can become more competitive by investing in its chemical industry

Turkmenistan’s exports are concentrated in hydrocarbons, with natural gas and oil comprising over 88%. Gas exports alone were nearly 68% of the total in 2024. Such a high concentration on resource-based products has made the country vulnerable to external shocks and fluctuations in the terms of trade.

Turkmenistan has several active initiatives to add value to its traditional exports and turn them into more complex products. Diversifying and innovating products for export is high on the government’s agenda, as expressed in the President’s program for 2022–2052.

The country has established petrochemical plants to convert natural gas into highervalue products such as polyethylene, polypropylene, polyvinyl chloride, methanol, formaldehyde, resins, synthetic rubber, and paint materials. These products are essential for manufacturing plastics, fertilizers, and other industrial chemicals.

Further, Turkmenistan is building gas-to-gasoline plants that convert natural gas or other gaseous hydrocarbons into highquality, low-sulfur gasoline able to meet stringent environmental standards, as well as gas-to-liquid plants to convert gas into diesel and jet fuel, which are more valuable and have a broader market.

Under the Program for the Development of the Oil and Gas Industry of Turkmenistan until 2030, one of the main tasks is to increase the production of high-tech oil and gas chemical products for export to global markets.

The government has outlined several initiatives to expand its chemical industry, notably moving from lower-value bulk chemicals to more complex and higher-value fine chemicals. By exporting complex chemicals, Turkmenistan could integrate more deeply into the global market, establish trade relationships with various advanced economies, and enhance its international economic presence.

Turkmenistan can become more competitive by investing in its chemical industry, using natural gas as a crucial input for production. Natural gas can be converted into such chemical intermediates as methanol, ammonia, and other fine chemical compounds. By investing in advanced technology and infrastructure, Turkmenistan can establish facilities to produce such electronic chemicals as high-purity solvents, photoresists, and etchants.

Diversifying into complex petrochemicals with higher value added would require other changes. They would entail significant advances over existing infrastructure, knowledge, technology, and market strategies, as well as substantial investment and policy support. ///nCa, 10 April 2025